Jan 27, 2026

Processes animal waste to create food and fuel products. With regulatory frameworks now requiring oil and polluting companies to purchase credits, Darling's secondary business of selling those credits should accelerate growth. A defensive asset trading at low valuation with growth acceleration potential — and the market loves defensive assets lately.

I’ll let AI explain what the company does.

Darling Ingredients is the world’s largest renderer - it collects and processes animal byproducts (fats, bones, grease, used cooking oil) from slaughterhouses, restaurants, and food processors, then converts them into usable products.

Revenue comes from three segments: Feed (animal feed ingredients like protein meals), Food (collagen, gelatin for food/pharma), and Fuel (renewable diesel feedstocks). The company also owns 50% of Diamond Green Diesel, a joint venture with Valero that produces renewable diesel.

Essentially, Darling turns waste into value across the food-to-fuel chain.

The use cases and products sold by Darling are manifold, and you can understand that most of them - if not all, will be in demand in any kind of market & economic conditions: they are necessary for the functioning of a society.

This is defensive investing 101.

As for why the stock could push higher? There is more to it than just a defensive asset at a low valuation - although that’s what Darling is at the moment.

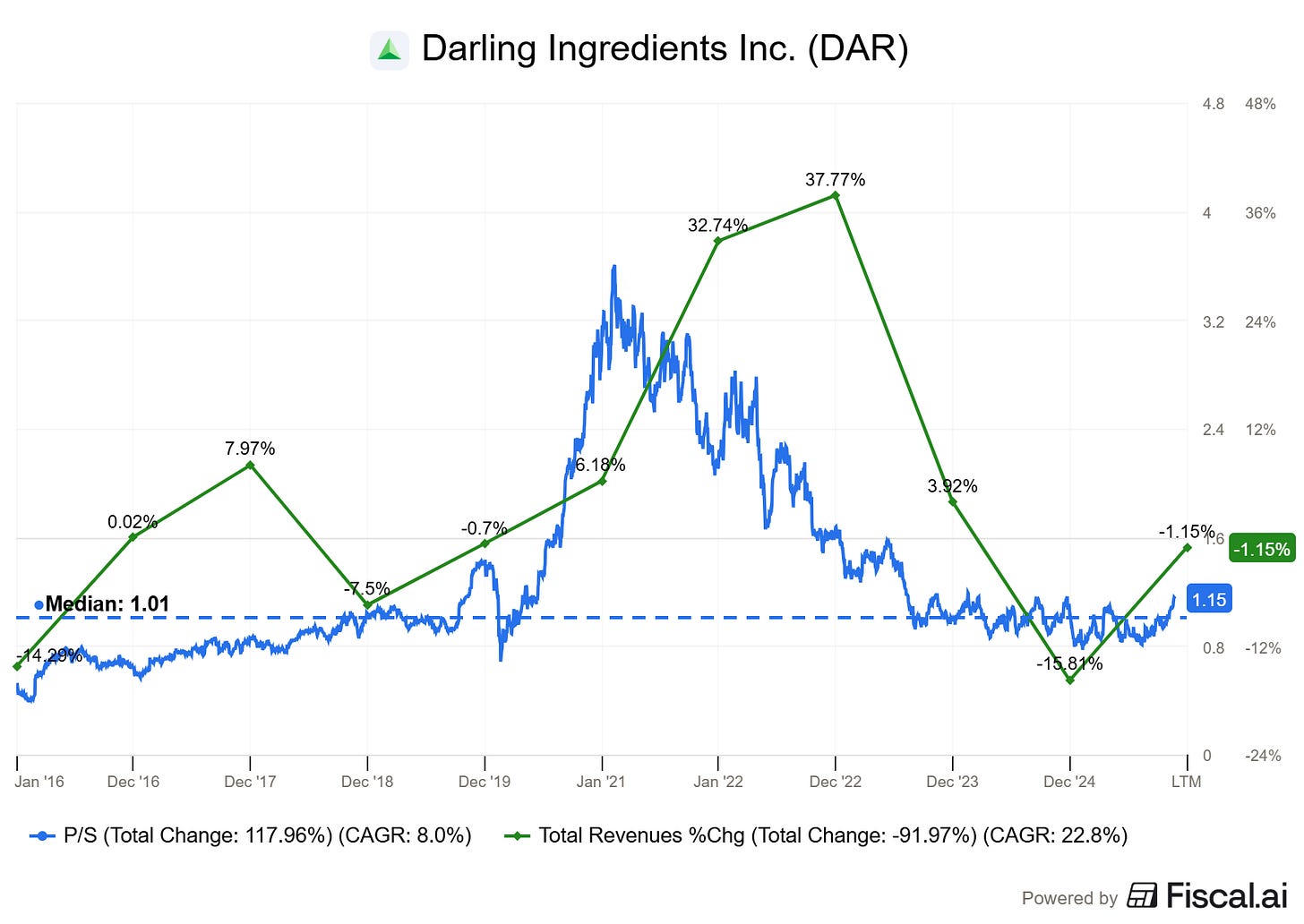

It could look like we are already above average, but when you bring growth into the mix - which is clearly accelerating and has reasons to continue, you see that if this trend persists, Darling has room to run.

It could deserve a higher multiple for two reasons:

Being a defensive asset actually in demand

Accelerating growth with clear tailwinds

The clearest tailwind is regulatory changes around biofuels; The government is about to force oil companies to buy a lot more green fuel credits and Darling is one of the biggest producers of those credits.

Using biofuels earns them credits (called RINs), and companies have a requirement of credits per year to avoid penalties. Until the end of 2025, regulation on the amount and the implementation of penalties & ratios was unclear. That changes early 2026.

That will benefit Darling twofold.

First, they produce and sell biofuels themselves, which some companies will be forced to buy. Between their own business and Diamond Green Diesel, this represents ~30% of their revenues.

Second, they also sell credits which they get from collecting and transforming wastes directly. Their core business model earns them credits which they can sell on a market where demand is only growing, pushed by regulatory frameworks.

As you can see from the screenshot above, revenue acceleration can push the stock to a 1.5x–2x sales, which would be a ~30% to ~70% increase from today’s price; more from my buying target.

Investing Playbook

You should be used to my charts and the patterns I look for by now! So no surprise to see that Darling fits perfectly.

An almost four-year-long downtrend that ends in higher low, weekly average reclaim, and earlier high breakout. We’re still fresh here; the retest hasn’t happened yet, and this will be the target. I’d look to buy around ~$40, while the averages are a bit lower at ~$36. This is the range to buy.

As for the plan, it is up to each of us as usual. For me, this would be an option play, as we are talking about a cheap defensive name in today’s market conditions, a perfect price action and clear narrative. It’s hard to imagine the stock break its lows, and as Darling doesn’t pay dividends, holding common shares is a bit less interesting.

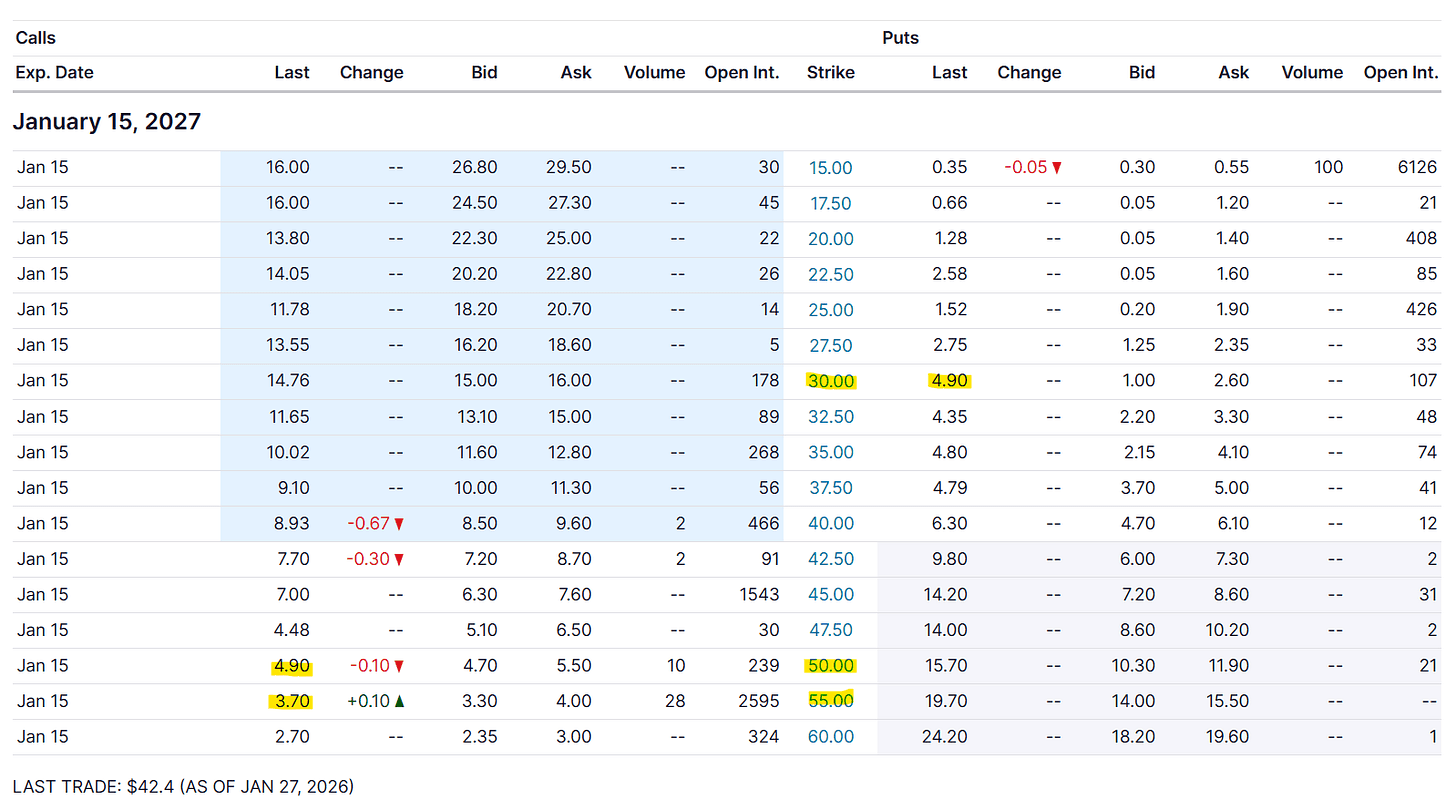

With the regulations changing, we’ll need to give companies time to adapt and start their new credit purchases & workflows. A year out seems to be the minimum. With our lows at ~$30 and our target of 1.5x sales at ~$55, this gives us our plan for our reversal options trade.

At today’s price, we’d already be in a good position to get paid for taking the trade. Puts sold at $30 would pay us $4.90 per contract; calls bought at $50 would cost us exactly the same. Being a bit more optimistic would with a $55 strike pays $1.20 and require $3,000 of collateral per contract without margin - which I would use with a year to go minimum on those contracts.

This looks like a great trade for the next year, although it relies on some regulations which should pass but could bring volatility if things were to be changed or reviewed. It isn’t my first choice nor my priority, UPS or Novo are, but it is a trade I would take if my other options were not possible.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.