Jan 27, 2026

One of the world's leading fertilizer producers, potentially entering a growth acceleration phase as demand rises while supply remains stable at best, with expansion projects slowed or cancelled. A defensive asset trading at low valuation with growth acceleration potential — and the market loves defensive assets lately.

We’re still in the food sector, with one of the biggest fertilizer companies.

Nutrien is the world’s largest fertilizer company by capacity, formed from the 2018 merger of PotashCorp and Agrium.

Revenue comes from four segments: Potash (potassium-based fertilizer - they’re the #1 global producer), Nitrogen (ammonia, urea), Phosphate, and Retail (Nutrien Ag Solutions with over 1,500 farm retail locations selling seeds, crop protection and agronomic services directly to farmers).

The vertically integrated model spans from mining fertilizer raw materials to selling directly to the end customer.

This is a comparable thesis to Darling in some respects, although the growth story isn’t tied to regulations, it’s organic from growing demand for their products while supply remains stable at best, which means pricing power.

Through the first nine months of 2025, Nutrien delivered structural earnings growth through record upstream fertilizer sales volumes, improved reliability, and higher retail earnings. We raised our 2025 potash sales volumes guidance range for the second time this year.

Our positive outlook is formed by strong potash affordability, large soil nutrient removal from a record crop, and low channel inventories in most major markets. This is most evident in China, where reported port inventories are down by more than 1 million tons year over year.

We anticipate limited new global capacity additions in 2026 with announced project delays and remain constructive on supply and demand fundamentals. Global nitrogen supply challenges are expected to support a tight supply and demand balance going into 2026.

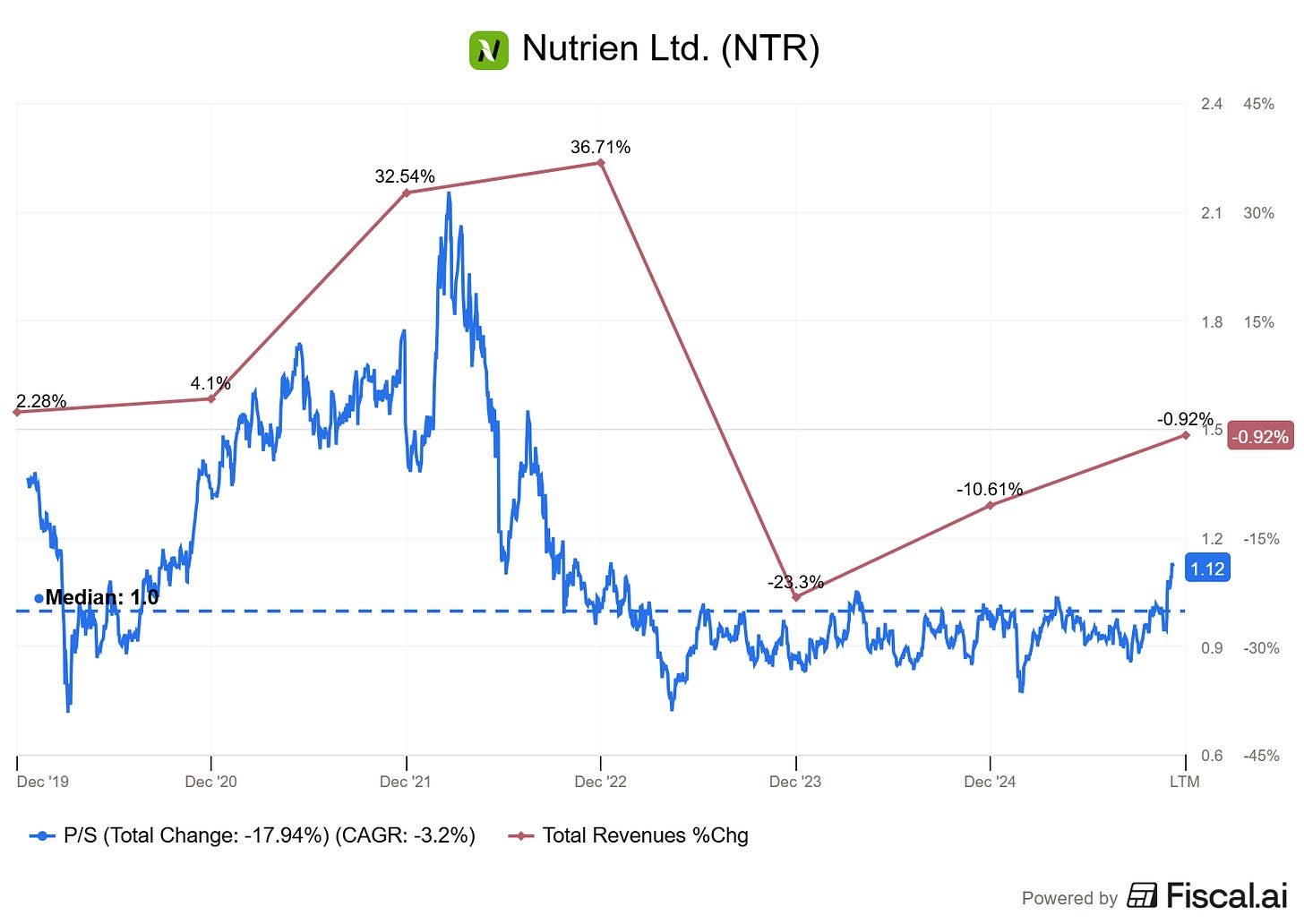

And this also comes at a pretty low valuation due to declining revenues and no love for defensive assets for years.

As you can see, the last time growth accelerated, it pushed the P/S from 1x to 2.1x which, combined with a ~30% revenue increase, yielded ~140% returns. I am not saying the same will happen over the next two years, but it is a possibility with the actual state of the market and demand/supply dynamic.

Investing Playbook

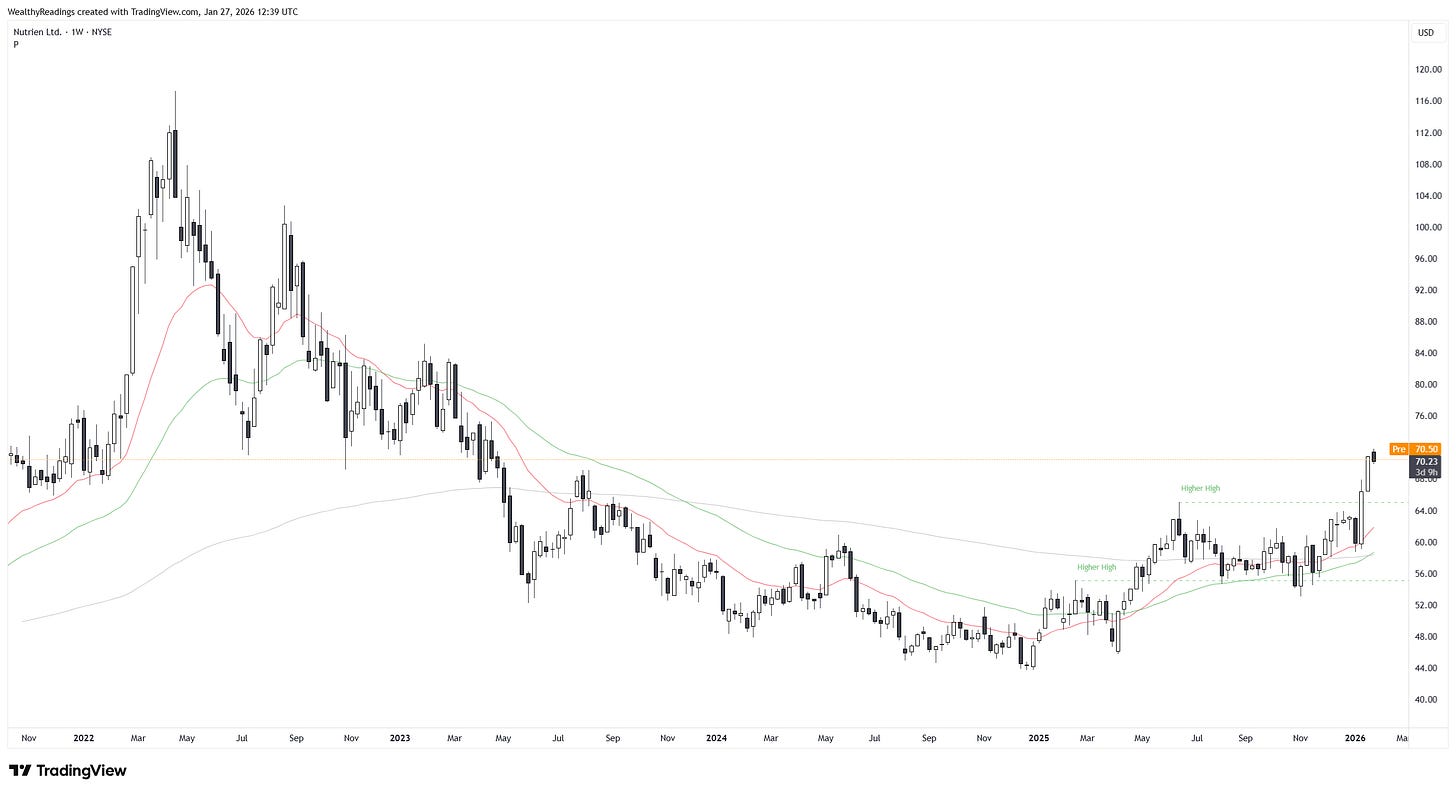

In terms of price action, we are a bit late to the party, as the great entry was on the $50 retest after a clear breakout and reclaim of the weekly averages, a purchase already up ~25%.

But as shown above, we are still at a fair value - undervalued if growth does continue to accelerate. The retest around ~$65 would still be a great entry, with a potential 30%+ return in a stable growth scenario. Anything above expectations - which aren’t that high, could bring the stock close to its old 2x sales peak. That wouldn’t be my base case, but it could happen, yielding 70%+ returns from the ~$65 retest.

Nutrien pays a ~4% dividend yield, which makes it a better candidate for commons and sitting on them, waiting for time to do its work. They also do buybacks, which would benefit both common and options holders, worth noting.

With the same options playbook, we’d be looking at puts sold around ~$55 - current low, and calls bought around ~$85 - 1.5x sales. We’d need to see growth acceleration confirmations to justify higher multiples. As of today, both contracts are at $3.50, so a free setup for $5,500 of collateral without margin.

This is the least interesting trade of the three, in my opinion, because we are a bit late to the party and the trade should have been taken on the previous retest. But we are still talking about ~30% returns on a base case using common shares, more with the options trade, and more depending on growth acceleration, which management is confident about, at a very comfortable valuation which makes risk vey tolerable.

We’re still looking at a defensive asset.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.