Feb 13, 2026

Nebius FY25 detailed review

I usually do not do detailed reviews for assets I do not own anymore, but Nebius is an exception and not only do I want to write this, but I believe many of you will enjoy it, even if I continue to believe the market won’t reward it anymore – at least for a short period of time.

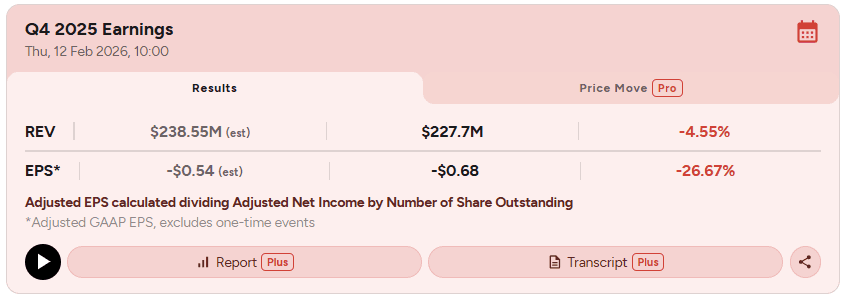

Don’t be fooled by the earnings overview, this quarter wasn’t a miss.

I’ll start by commenting on the quarter from a fundamental point of view only – and there aren’t many bear points to comment on; I’ll talk about the market’s perspective and why I am not overly bullish on the stock itself after.

Because yes, one can be bullish on a company and not on its stock.

The Perfect Bull Case

There is nothing wrong with this quarter in my opinion; some of the bear cases are even falling, their myths being deconstructed. Nebius bull case remains to compete with hyperscalers with high compute quality, availability and pricing.

And they’re great on everything while the market continues to be supply constrained with very high demand, but we knew that.

We sold out of capacity in Q3 and Q4 last year, and we’re already now in Q1 of 2026, also sold out.

Even before we bring capacity online, it’s often, it’s often sold out. As a result, the average contract duration of new cloud customers grew by 50%, and the prices of GPUs didn’t fall, even on previous generations of GPUs, as the industry may have expected. Customers are demanding more compute and increasingly, increasingly sophisticated solutions to run their AI workloads.

And not only is demand and quality expectation high now, but it is high for the future as commitments are increasing and companies are fighting to secure their shares of compute, even if it means at a slightly higher price.

In Q4, we saw nearly twice as many transactions completed for over 12 months in duration over what we succeeded with in Q3, while average selling prices increased by more than 50%. As an example, we are sold out of hoppers, and those that are coming up for renewal, often off of short reserve agreements, are getting renewed at 12 months or longer, while we’re actually seeing pricing nudging up.

Which means management is optimistic. Logically. Especially while also being on time to deliver their (very large) contracts with Microsoft & Meta and having a very high demand even on holder GPU generation - which was one of the first bear case.

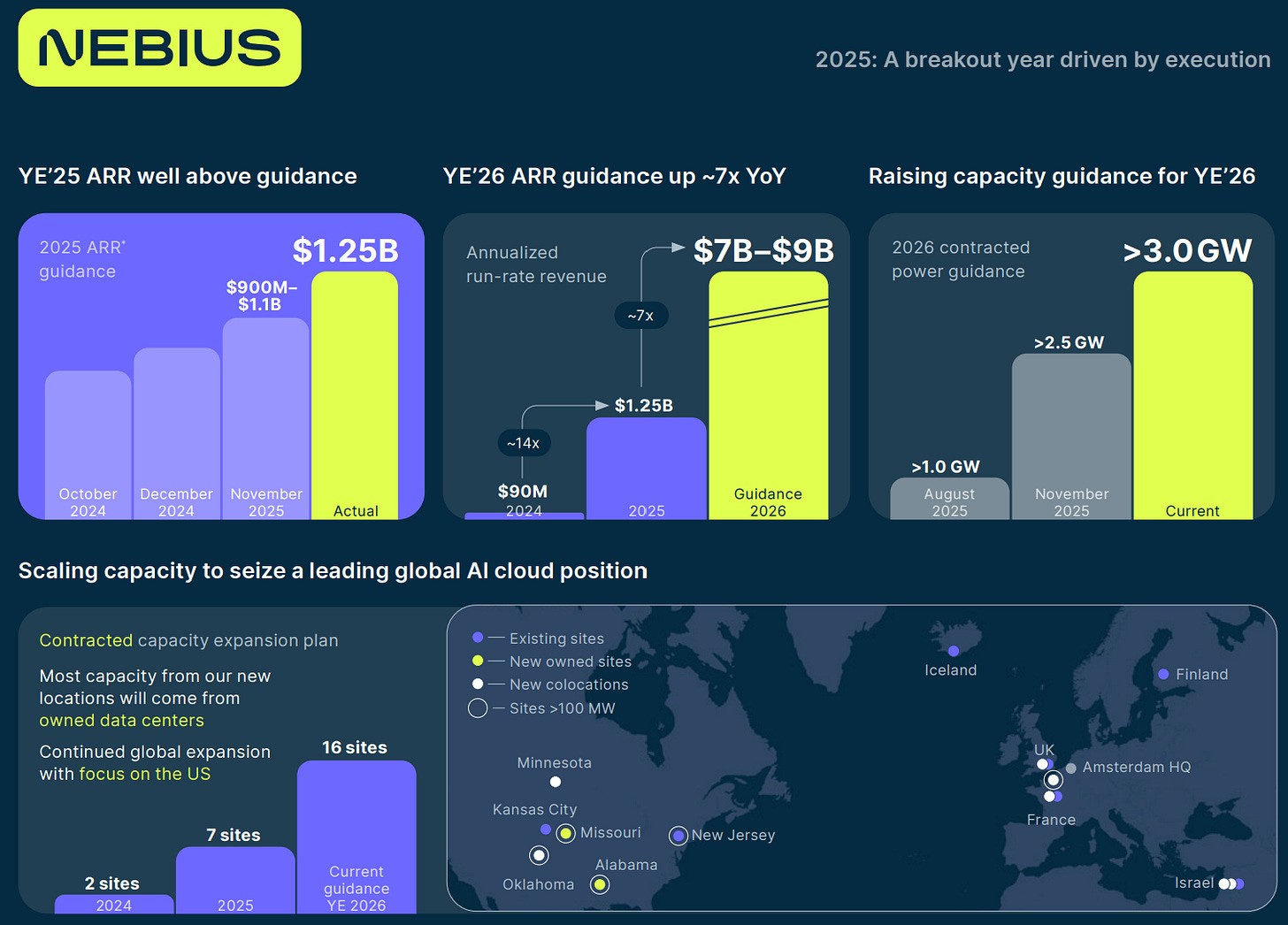

We are reiterating our annualized run rate revenue of $7B - $9B by the end of 2026. For the full year, we expect to achieve between $3B & $3.4B in revenue.

Over the last few months, our conviction in this range has become stronger. Why? Because, because we exceeded the high end of our 2025 ARR guidance and showed more than $1.2B ARR. Because we already contracted more than 2 GW of capacity and are on track to exceed 3 GW this year. Because we have already delivered all of our capacity for the Meta contract, because we are on track to deliver the capacity for Microsoft through the course of 2026, exactly as planned. And lastly, the demand, demand for our AI cloud continues to be strong. Pricing is strong.

Everything seems perfect and who wouldn’t be bullish up to here?

The challenge is the same for Nebius as for any hyperscaler and compute provider: to grow supply, which means more infrastructure, GPUs, energy consumption; and that takes two things: time & money. Two things Nebius has, which is why I’ve loved this stock more than others.

And they are showing it by expanding and accelerating their buildouts.

They exceeded their own FY25 ARR guidance, were sold out on capacity, reiterated their FY26 ARR guidance based on today’s very positive market dynamics, and increased both their FY26 contracted power guidance and the number of datacenters they intend to have running from 7 to 16.

Massive demand requires a massive expansion plan.

And compared to many companies – like Oracle, Nebius still has very strong shoulders to expand, so while the market worries about CapEx and debt, Nebius management has this kind of comment.

In order to capture the large and growing opportunity that we see for the future, we plan to invest in CapEx in the range of $16B - $20B in 2026. We already have about 60% of the capital needed for this range from our balance sheet, existing operations, and commitments.

We evaluate several funding options available to us on a consistent basis, and we’ll deploy two guardrails when we look at capital alternatives. First, we will focus on raising debt relative to our business needs and will be prudent with respect to the cost of capital. Second, we will be mindful about the shareholder dilution if we choose to issue equity. Given our balance sheet and minimal debt, we are fortunate to have many additional options to finance our growing business.

For example, we are currently exploring adding corporate debt and asset-backed financing to our balance sheet.

But most importantly, I would say, we have significant amount of cash that we received, and we will continue to receive in 2026 from the favorable terms of our long-term contracts.

In English: they have enough money and will generate enough more to finance ~60% of their expansion, while the rest could be financed by asset-backed debt, leveraging their stake in ClickHouse, Avride, Toloka or else… Minimum debt & dilution.

Everything to please the market. And yet…

Nothing is Never Enough

As I’ve said for weeks, maybe months now, nothing I shared above matters anymore.

The market is not looking at potential, it is looking at facts and pricing risks. Today, it only sees a company which cannot accelerate growth because its limit is not reach or engagement, but physical constraints with slow buildouts while spending accelerates to capitalize on an opportunity which could shift in a year’s time.

Who says demand for compute will be equal in a year?

Who says new hardware won't be enough to meet it?

I personally do not believe this, I believe buildouts are necessary & Nebius will thrive. But the last time I tried to give my opinion to the market and told it my stocks should go up… Well, it didn’t care – rightfully so.

What matters is liquidity, risk appetite, sentiment.

Today, Nebius is a $23B company telling the market its growth & cash generation are constrained by physical ceilings which cannot be avoided and is seen in this quarter’s revenue miss, while it decides to spend a small 100% of its capitalization on buildouts whose usefulness is a question mark.

That's what the market sees. And just like you, I find it stupid.

But again: My opinion doesn't really matter.

And if we could build faster, yeah, and even more than we have today, we would do it. So we're building because it's clear growth.

And if they could, the market wouldn’t punish them, because growth wouldn’t be linear; it would be exponential.

Investment Execution

A company and its stock are two very different things.

So I will stick to my opinion that Nebius is an excellent company the market will not reward because of uncertainty, execution risk, and growth ceiling. And I’d love to be wrong. If you believe the next 5 years are nothing but rainbows and unicorns and you feel capable of holding a potential growth stock in downtrend – which isn’t the case yet but could become it, Nebius is certainly a great name to accumulate at today’s price.

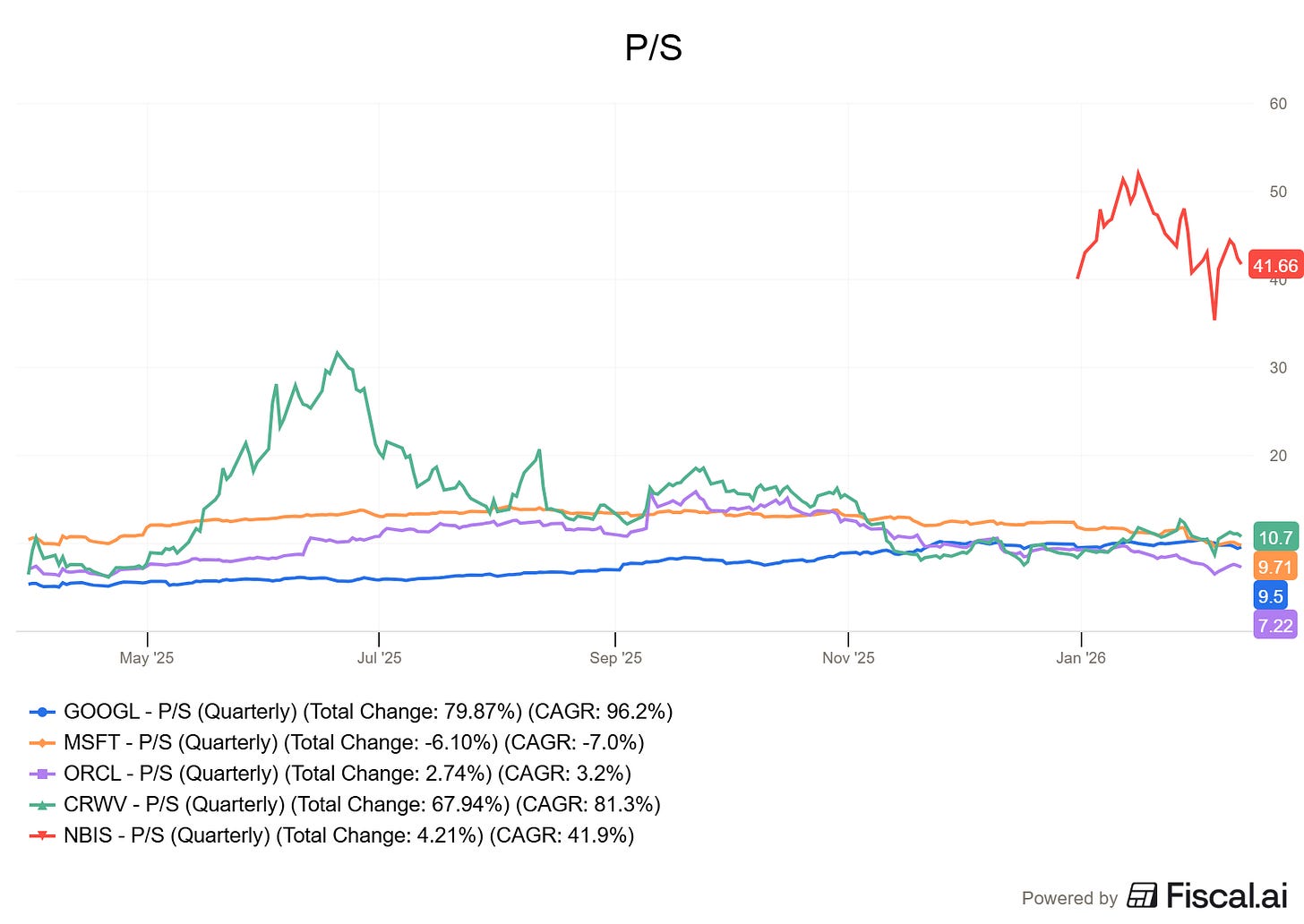

I’d personally hold as long as we are above the weekly 50 but I would be cautious and aware of the risks and market’s reactions. As long as Google, Microsoft & co are not rewarded for expanding and insatiable demand, I don’t see why Nebius would be, especially at today’s valuation.

Although yes, growth is incomparable as Nebius is guiding ~500% revenue growth which would push its P/S down to ~10 by end of year 2026, matching others. To that we need to add execution risk and demand concerns by then, making Nebius the highest valuation and risk of them - except maybe for CoreWeave.

I remain very bullish on the company itself and hopefully I’ll buy back in a few months – maybe years. Who knows? This is an excellent company and I understand why many would like to buy and hold it. It’s just not how I personally do things, but to each their methods. Nothing wrong in that.

In the meantime, I’ll be patient and adapt myself to the complicated year 2026 is shaping out to be.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.