Feb 13, 2026

AsteraLabs FY25 results review

This was a good quarter, that’s all there is to say. The market has worries and reacted badly because of them, and we’ll dissect it, but I don’t believe any of those concerns are fundamentally concerning. What I see is a great company executing well in a key industry.

Growth for the year was broad-based, spanning across our signal conditioning, smart cable module, and switch fabric product portfolios as we continue to diversify our business profile with several new design wins across multiple customers.

To rapidly recap the bull case, which is pretty simple: the next step of AI computing is about optimizing compute to the maximum. As demand grows, supply is limited and we cannot expand it in a second – it requires infrastructure and energy access which take time to build – the only way forward short-term is to maximize compute capacity per unit of energy and space.

More compute in the same hardware & space, basically.

That is what Astera Labs is working on: optimizing compute with personalized plug-in hardware to set on their racks - which does not replace GPUs & other hardware, but complements them. Just like you’d have DRS on an F1. It doesn’t replace the driver nor the vehicle but makes its performance better.

Astera Labs is working on doing this for the next generation of hardware which is built on a networking technology called PCIe 6.0, which isn’t yet deployed in all hardware - but will be in the months to come.

We remain very early in the PCIe 6 transition cycle & anticipate additional customers will launch PCIe 6 capable AI accelerators and systems throughout 2026 and into 2027.

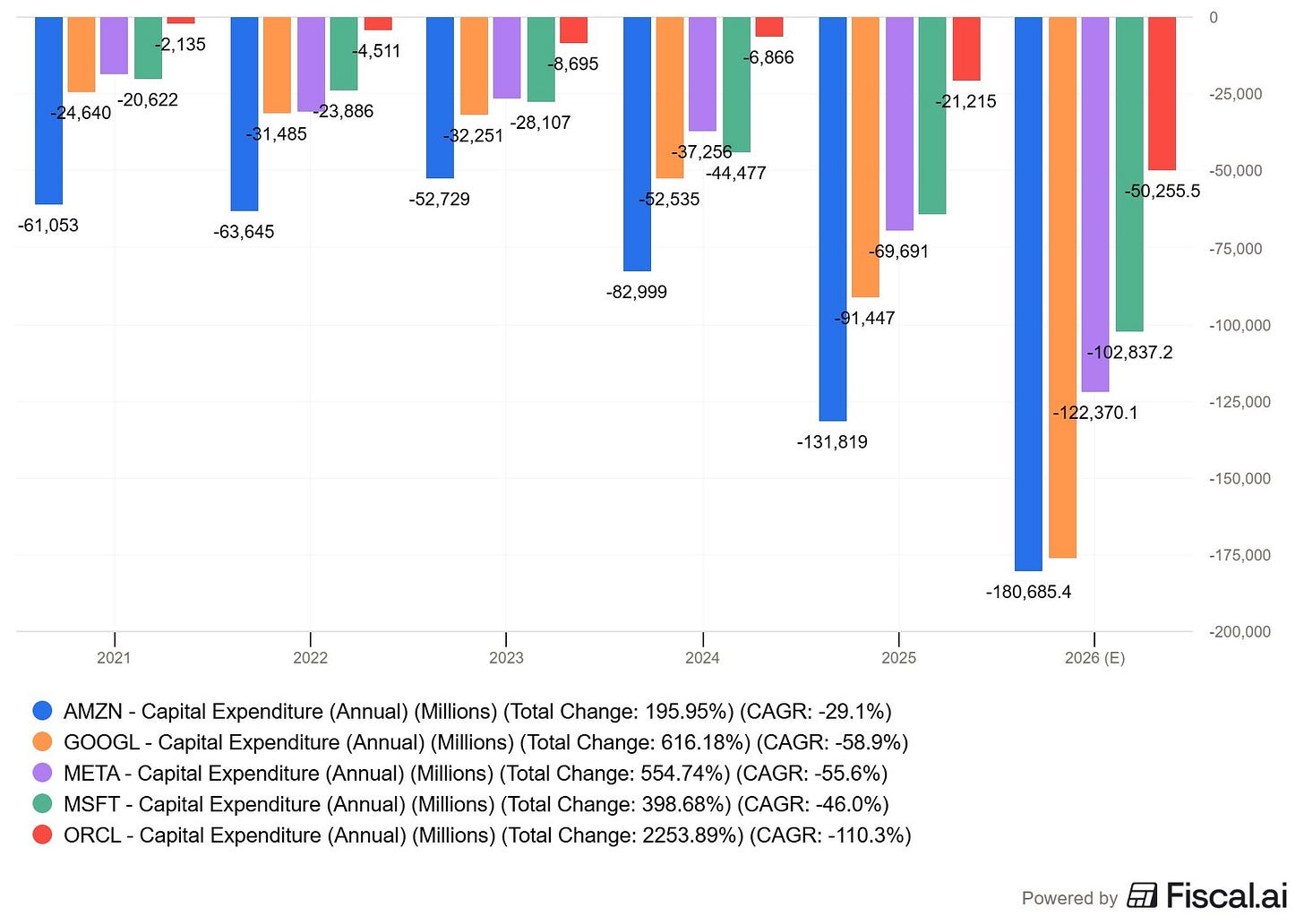

About the AI sector itself, I’ve shared many times I was worried about clouds, or the market’s appreciation of cloud stocks, because their growth could be slowed down by buildout delays and they were CapEx intensive. On the contrary, I remain bullish about AI hardware because those companies take cash in today, without constraint – that’s Astera Labs.

Hyperscalers have all confirmed massive CapEx increases for FY26, meaning more cash will be spent on infrastructure, and with the most important metric being compute per unit of energy and space… This money is literally going towards companies capable of pushing performance further, and spending is accelerating.

Up to here, the bull case is really strong, and it doesn’t get less strong as management confirmed they were in conversation with many hyperscalers, won new contracts this quarter and increased their partnerships with the rest, including a $6.5B warrant with Amazon disclosed in their 8-K.

Just to point out, we did file under a warrant agreement with Amazon today. It demonstrates our strong relationship with Amazon. Under the terms of the warrant agreement, we’re issuing 3.3M warrant shares that, based upon the achievement of performance conditions, comprise specified tranches of payments to purchase up to $6.5B of our smart fabric switches, signal conditioning products, and also our optical engine solutions.

In easier words, Amazon gets the right to purchase up to 3.3M shares at $142.82, with warrants vesting progressively as they purchase up to $6.5B of Astera’s products over 7 years. No promises, just steps unlocking as Amazon buys products. If Astera delivers on quality, everyone wins. This is the second warrant between both companies; Astera already satisfied Amazon on their first – which was increased after completion. Happy customer.

I won’t comment on the margin impact of this warrant as, just like depreciation and amortization for cloud companies, these will be non-cash expenses and are only accounting masturbation. Cash-wise, this has no impact, so it’s noise in my opinion.

The only valid “bearish” take on this warrant is that it looks like Astera was forced into it - although they did it already and everything went well the first time. But a possible way to look at it is that if they didn’t have any competition they wouldn’t have had to make a warrant contract. They’d just sell their products at market to Amazon. But this is also how relations are built so this “bearish” take could have many “bullish” counter takes, all as valid. It’s about interpretation here.

And on the data itself, everything seems to go according to my bull case, and most of the data and comments from management confirmed this. But the market focused on three main concerns.

Quarter Overview

Before digging into the market reaction and reasons, let’s look at the quarter.

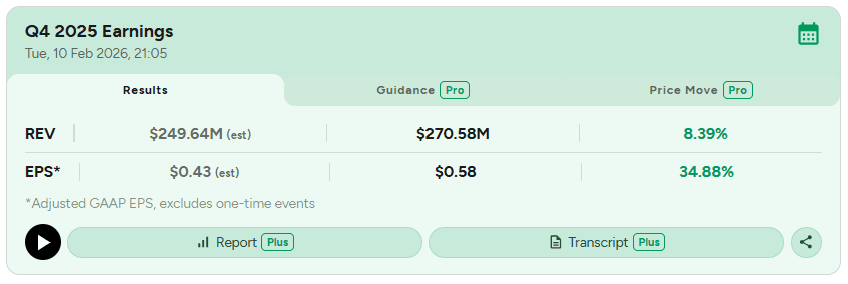

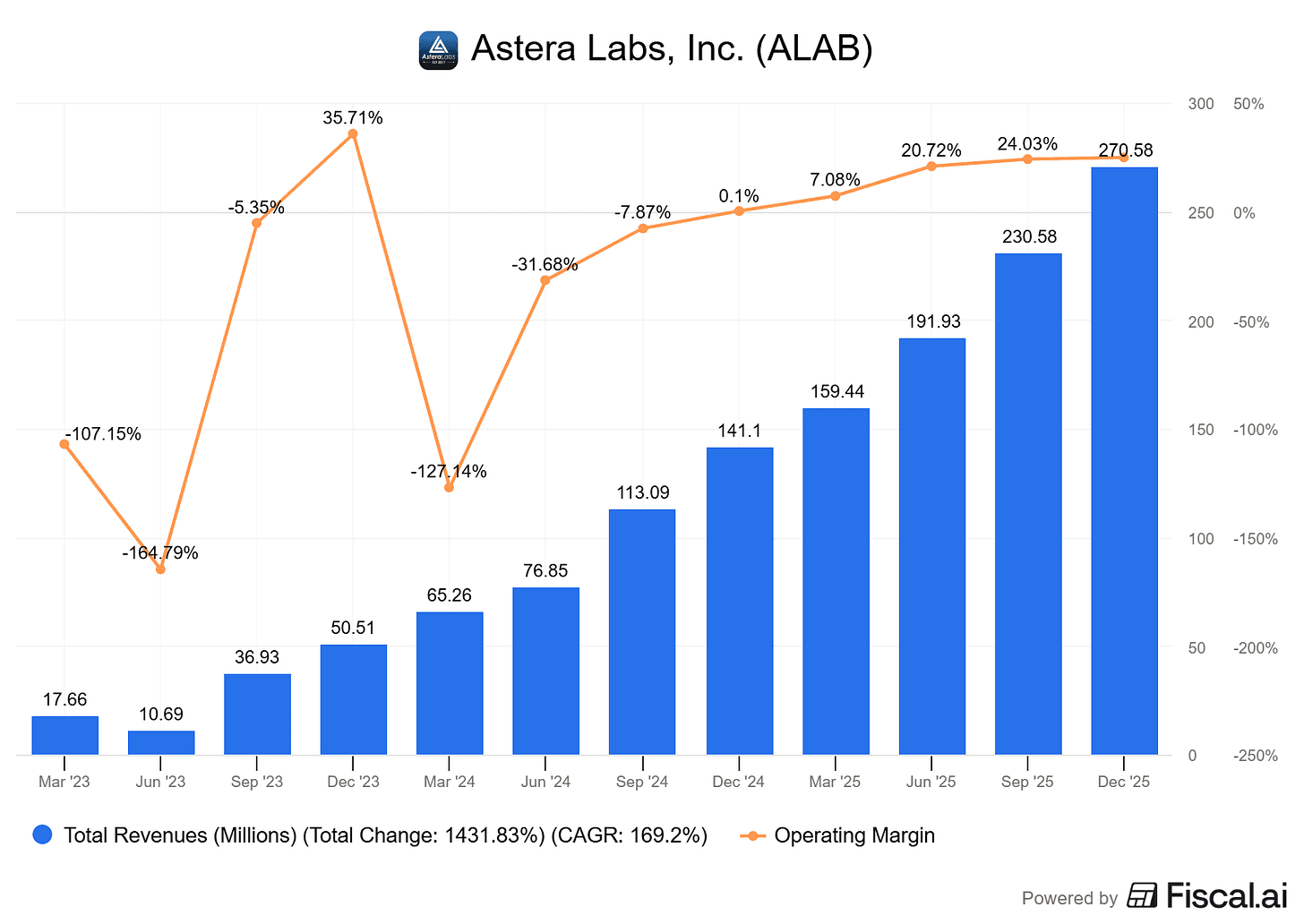

A +17% sequential revenue growth and 92% YoY growth for this quarter, and a year closing up 115.13%, with strong margins although slightly declining due to product mix as we’ll see later, but ~75% remains strong. Cherry on top, increasing operating margins leading to very healthy profitability, which could look declining only due to tax benefits in previous quarters which did boost.

For the quarter and the year closing, there isn’t much to worry or be unhappy about. Guidance came maybe a bit “weak” with 6% to 10% sequential growth, but guidance was weak for this quarter as well and Astera ended up beating its own guidance by 7%+ so I wouldn’t worry about it too much, especially as the growth engine is not supposed to accelerate yet.

Why would the market sell off that much then?

Nvidia NVLinks

Margin Pressure

Expenses growth

The Uncertainty

Astera Labs is not the only one focused on improving compute quality and capacity; others do too but most importantly, Nvidia is trying to be self-sufficient. We’ve talked about this already but it seems to be a recurrent theme, so here we go again.

Nvidia sells racks. GPUs interconnected, to be plugged, configured, and used. Those used to be proprietary for A to Z but Nvidia realized they couldn’t personalize for so many clients, so they delegated and accepted building customized racks.

Furthermore, hyperscalers are demanding flexible connectivity solutions optimized for their unique architectural approaches and application needs, i.e., one size does not fit all.

And because these are homogeneous links and everyone is trying to eke out the maximum amount of bandwidth and performance on the connectivity side, so in general, what you will expect is there is quite a bit of customization that will be needed. So what we have tried to do is not do one silicon for every opportunity, but to be able to leverage the same piece of silicon, but to be able to customize that in many different ways.

Our initial prospects in the custom solution space will help to enable NVIDIA’s NVLink Fusion scale-up architecture for hybrid racks, and we are seeing opportunities to support additional hyperscalers to provide interconnect flexibility and optionality.

This started with Blackwell; clients could ask to add constructors’ hardware within their racks - Astera Labs being part of the options.

The worry today is that as Nvidia improves its network connectivities with UALink and NVLink, the Rubin racks (Nvidia’s next generation) are good enough by themselves and won’t need Astera Labs’ hardware anymore – or less of it.

I won’t say this isn’t true: it could be. But I have three counter arguments.

Blackwell showed that demand for personalization is through the roof and Astera Labs’ hardware sees a large demand, proven by this quarter’s beat led by Scorpio P demand. Nvidia cannot handle such volume and need specialized hardware to optimize its racks and hyperscalers are happy about this - at least they buy it. It’s hard to see why Rubin wouldn’t follow the same path

Starting with Scorpio, our P Series family continued its volume ramp at our lead customer, with growth coming from both existing and incremental platform designs.

For the full year, Scorpio P-Series exceeded our target of 10% of revenue and remains the only PCIe 6 fabric shipping in volume in the market. Looking at 2026, we anticipate continued growth for Scorpio P-Series at our lead customers, as well as commencing shipments into at least two additional major hyperscalers on their next-generation AI platforms.

Management has many conversations with the main hyperscalers, and those are committing not only on Blackwell, but on engineering the next generation of optimizing hardware for Rubin and beyond, as many are even working on optical specifications – which won’t happen before 2028, while Amazon confirmed its $6.5B warrant based on performance. Hyperscalers trust Astera Labs, not just for Blackwell but for future generations.

And as the hyperscaler customer announced at their public event, they want to continue to deploy Vera Rubin also as a custom deployment. So we will certainly do our best to make sure that we are part of that solution as well as the designs transition from Grace Blackwell to Vera Rubin.

The market is pretty wide and Nvidia isn’t the only competent GPUs. While some will use NVLink and UALink, with or without Astera Labs, others won’t use Nvidia’s products – without NVLinks, use other GPUs or in-house ASICs. Astera can adapt; they work where the opportunities are. For now, it is on customized racks because that is what their clients are asking. They’ll adapt if necessary.

We do indeed think that these solutions will coexist. We are primarily developing solutions where our customers are asking us to, which happens to be PCI Express, UALink, and now increasingly on NVLink Fusion.

If we choose to design an ESUN-based solution, we can. However, as has been the trend with Astera, we listen to our customers very closely. So far, everybody is telling us to focus on UALink. And that’s what we are focusing on. As you say, if things were to shift towards ESUN, we certainly have the capability.

Although to be fair, Nvidia remains king and Astera has to work with them. So my first two points are the most important ones: so far it seems that demand points to more customization, even with Rubin.

With that, the growing CapEx and semi companies generating cash… I do not see why I wouldn’t be bullish on Astera Labs. It will take some time to prove itself, although to be fair, what I see should already be proof enough.

We are talking about a double beat, a beat on guidance all due to outperformance of their #2 most important product which isn’t in production volume yet – Scorpio P, with massive demand and specification discussions for their #1 product supposed to ramp up production H2-26 – Scorpio X, while other products also performed well.

It just launched for the first time in Q2 of this year, and it did break above our 15% for the year. It grew very nicely in Q4. This is all on the Scorpio P primarily, which is scale-out switching. We did say we just started shipping initial volumes here in the Scorpio X, and that will have increasing volumes as we enter into 2026 with a much more material ramp in the back half of the year. Scorpio, by far, is our biggest TAM right now. It’s growing at a very fast clip as a result of that.

I understand the concerns, but I do not share them.

CapEx, Opex & Margins

The second aspect the market did not like was the increase in expenses and, logically, the reduction of margins and cash generation. I am bullish on hardware companies because they are supposed to not rely on CapEx to generate cash, so increasing their expenses makes Astera closer to cloud companies than semi producers.

Two acquisitions – aiXscale & Pliops assets, increased expenses without near-term monetization potential, as those are for future products.

As we spoke on the call, the TAM is much bigger than we originally expected just when we measured it just 12, 18 months ago. So we are increasing our investments to pursue these opportunities.

Last quarter in Q4, we did close the X-Scale acquisition, and now we have a full quarter in Q1. And then just recently in this quarter, we closed another acqui-hire where we got a very sizable, capable team to help us scale up our new Israel Design Center, where we just also brought in very exciting, capable leadership as well.

Those are expenses due to demand, not just to spend money, which highlights how advanced the discussions with hyperscalers are when we’re talking about specs for products to be commercialized in 2 years+.

Over the last couple of quarters, we’ve been having a lot of advanced dialogue with our customers, and they’re presenting us significant revenue opportunities that we really feel now is the time to really invest in.

With the concerns shared above and from the market’s perspective, this is a company accelerating expenses for products for which demand might slow down due to Nvidia and its new networking hardware.

My opinion remains that the market is reacting to a narrative which is proven wrong by every comment and answer given during this call. Assuming management isn’t lying and conversations for their products are indeed real, hyperscalers are working on designing their next generation of Astera hardware and committing on Rubin & further generations. This requires a bit more spending and might slow down short term cash generation very slightly. No counter points here.

I personally find the fear a bit overblown, but at this valuation, volatility is expected.

Investing Execution

Before going over what I’ll do, I think it can be interesting to look at what I did until today, as I am happy about how I managed this stock and that could interest you.

As you know, I position myself using price action. Today, Astera Labs is confirming a clear range between ~$190 and its weekly 50 which is constantly bought at ~$145 today – green line on the chart.

As I modified my portfolio last week, I closed Nebius at ~$86 and rotated into Astera with options when the price was ~$145. Classic reversal strategy for me.

Sold puts ALAB Apr17’26 $130 for $16.67 credit

Bought calls ALAB Apr17’26 $165 Call for $15.69 debit

I got paid $0.98 per contract to bet that Astera Labs will close above $130 by April. I’ll have positive returns as long as this happens, with unlimited upside above $165.

You can notice that my sold put strike is below the local low & my call strike is middle of the range. As long as the stock continues to range, I’ll make money – this position is still green today after the stock falling 19.7% at time of writing.

As the stock pushed to the high of its range pre-earnings, a ~35% move in four days, it was clear to me that it seemed better to be safe than sorry. By then, I knew that the real ramp-up won’t happen before H2-26 - that was the base case. This quarter was not a pivotal quarter & the chances of breaking that range strongly were very slim.

So I took the opportunity and sold ALAB Jun18’26 $240 calls for ~$2,200 of credit per contract. I got paid to sell shares at $240 if the stock closed above $240 by June.

From here, I “cannot” lose as I have a bullish AND a bearish setup running.

Stock rockets? My bullish position prints and my bearish position falls. The gains aren’t as big as they should be but still consequential – while the probability of this happening was slim due to the quarter not being a key quarter.

Stock goes down? My bearish position prints. As long as the quarter was not disastrous and the stock holds $130 – which was also likely, I could take profits from the sold calls and use that liquidity to buy more, or simply close the position if I were unhappy with the quarter with minimum loss/small profits.

Today? The quarter was good enough for me, the stock is only back to its range’s low. I closed my sold calls, realized ~$1,000 per contract and now have liquidity left to… buy more, because I believe the bull case is intact while optimizing hardware remains a massive potential in the current market.

That’s the power of options. By playing with your setups, you create yourself… Options.

Over time & by leveraging price action, you can build situations where losing is close to impossible or with minimum consequences. That is, as long as you listen to the market, focus on price action, and accept that fundamentals aren’t everything.

On this Astera Labs trade, my bull position is still green – slightly, and unrealized. But I realized ~$1,000 of gain per contract sold by hedging my position and accepting that if the least probable situation were to happen – amazing quarter and +30% reaction, I’d reduce my gains to protect myself from the opposite situation.

Options aren’t just gambling. They’re another tools investors can use, and we should use everything at our disposition as long as we do it responsibly. This won’t make us less of an investor.

What Now?

As I said, I don’t see changes now. I’ll be patient as a -20% drop is violent and rarely bought back in the same day; there is no rush. But I intend to buy more with longer-term options – up to Q3-Q4; the potential is real and the concerns are overblown in my opinion.

Valuation didn’t change, growth hasn’t slowed, and if guidance looks a bit weaker for Q1, I wouldn’t worry as the real kick has to happen H2-26, hence with Q2 guidance & the ramp-up of Scorpio X and full production of P.

Moving to Scorpio X-Series, we expect to incrementally grow revenue in the first half of 2026, followed by a transition to high-volume production in the second half of 2026. We continue to make excellent progress with additional engagements looking to leverage PCIe for scale-up networking. As previously communicated, we are engaged with 10+ customers for Scorpio X Family, and our current expectation is that we will ship initial quantities of Scorpio X-Series to support new customer platforms in the second half of 2026 with volume ramps set for 2027.

My thesis would break if that were not to happen.

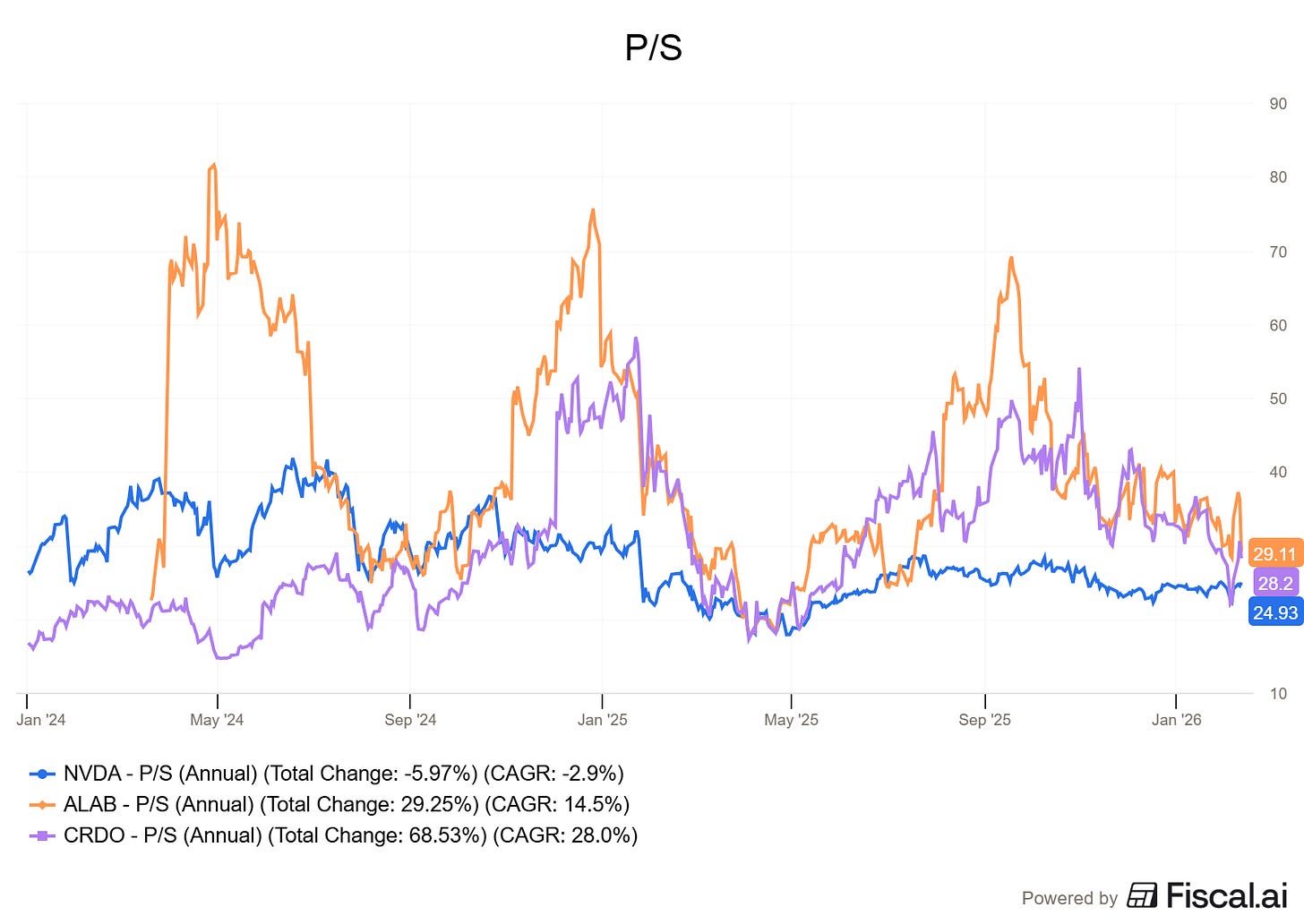

A bit more on valuation, which remains high as we’re talking about a high-growth and volatile stock. Let’s not pretend Astera is cheap: it isn’t, even compared to peers; but great opportunities rarely are.

So this has to be kept in mind. I personally am bullish on the sector due to CapEx, but we remain in a high-growth and volatile sector, which isn’t the safest one in today’s market conditions. As I’ve shared many times, I chose to remain in it as buildouts will continue either way, with market up or down, but I am aware of the volatility potential and would cut the position if it were to lose its key support and fall into the abyss.

Target is the same: Below $150, preferably on the weekly 50. And as long as we hold that weekly 50, which is clearly the price the market is looking at for Astera Labs, I’ll remain bullish and invested.

The option market is not interesting enough to grow the position at time of writing, but I’ll wait and observe, and if I can find great opportunities closer to ~$140, I’ll buy more with a timeframe to H1-27, when things should finally get interesting.

This is the minimum timeframe required to buy Astera Labs today.

The thing that we are seeing is a tremendous influx of opportunities. And that’s largely coming from the fact that we have spent about 12-15 months sort of being in the scale-up domain, and we have learned a lot. There’s a lot of unique things that become critical when you’re designing scale-up fabrics. And that learning has enabled us to better present our solution as well as the feature set that we’re incorporating in our new product lines. And those are gaining interest and support from several new customers. And to support that is where we see a need to step up our R&D, meaning the time to invest is now.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.