Jan 15, 2026

Danish healthcare giant and home of GLP-1 injectables and pills. First to market with their GLP-1 pill, which is seeing massive demand and potential as it expands the addressable market — many patients refused to use injectables.

Most of you will probably close this post in a few seconds. These assets aren’t what you expect from me, or from any investment subscription.

We aren’t talking about “the future” or potential 1,000% returns stocks. We are talking about old, boring companies. But sometimes, boring is where the money is. My job is to find profits, not thrills. I’ll leave the thrills to others, I don’t care about those.

A few months ago, I shared several ignored setups on X and here. No one cared then, but the results spoke for themselves: Dollar General (+72%), Dollar Tree (+74%), Schlumberger (+29%), and Halliburton (+47%). If you used the option strategies I shared for SLB and HAL, those returns were multiples higher.

These “boring” names outperformed the market and were much safer bets. Focusing on growth is great but making money is better, it is never boring, regardless of where it comes from.

Today, we’ll look at two assets. I’ll provide a review of the fundamentals, the upside potential and a clear trade plan for investing, as usual. I’ve planned this write up to be about four assets originally, including Target, JD.com and Devon Energy. I decided to cut those & focus only on the two best setups. I’m here to share the bets that actually matter, not just a long list of “meh” trades.

I intend to buy these two. The others? I wouldn’t have. So two it is.

I’m still heavily invested in “risk” assets like crypto and tech (Nebius, Astera Labs, UiPath, Alibaba). Currently, TransMedics is my only defensive holding.

But things are changing.

I expect my portfolio to be very different in six months as the market dynamics are clearly changing. I’d expect to be out of crypto and mostly out of tech by mid-26, depending on how the market will behave obviously but that’s my base case today. I won’t cut all my positions neither, but I want to take profit from this sector & follow the rotation. These setups are the best candidates for that rotation.

I’ll buy at least one of these in the next semester. Let’s see if “boring” continues to beat tech, as it has. And remember: returns are returns.

Novo Nordisk

You’ve heard of this one everywhere I guess. I did not like it then. I still have doubts & believe most who write about it are wrong. But it’s worth a few words, and maybe a few bucks by now.

And that is for one reason only: Novo now has a new lever for growth: The Wegovy Pill, their GLP-1 newest product, which hit the US market earlier this month.

This isn’t just a “cheap and stable” play. This is healthcare - a defensive sector, with a potential real growth lever in weight loss category - priceless product for millions. But I’ll start by setting the stage because social media is right about the opportunity. But too many ignore lots of parameters.

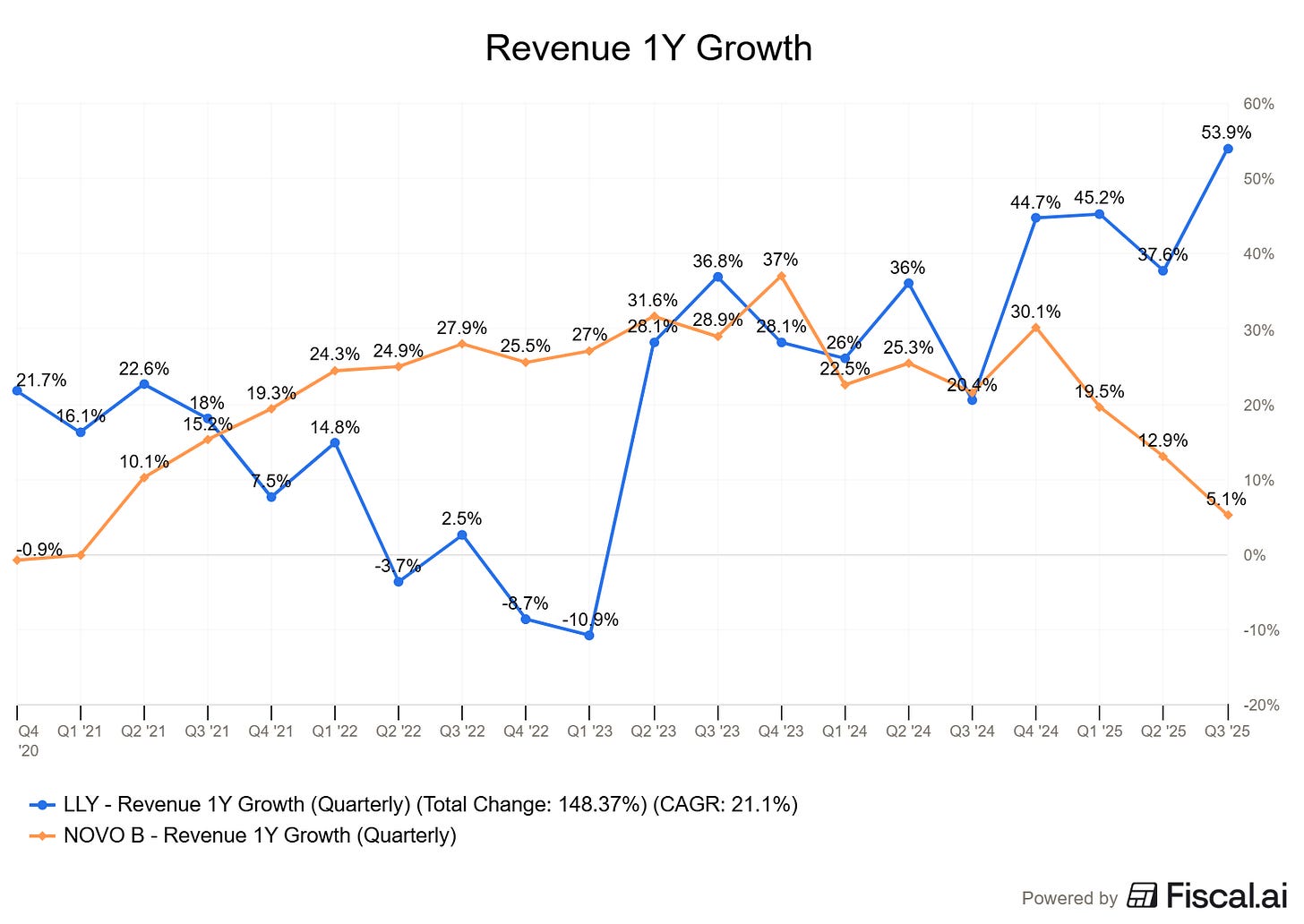

So, context first. Novo Nordisk took a beating in 2025 because their GLP-1 injectable is inferior to Eli Lilly’s. That’s fact. The market chased Lilly and ignored Novo’s just like patients chased Lilly’s products and ignored Novo’s. And it shows.

This was while GLP-1 were injectable. But GLP-1’s future is about pills, Novo’s already hit the market and Lilly is one or two quarters late with its own - Orforglipron. But it will hit the market during 2026, hard to know exactly when. If Novo can capture the needle-phobic now, they’ll take shares with sticky consumers before Lilly even arrives.

This is the bull case. First mover advantage, a sticky product at an aggressive price to onboard many, and therefore the potential for growth to restart. If that happens, then yes, Novo is an opportunity.

But let’s remain factual: The market only cares about Growth. Novo is not cheap at today’s multiples without it, and it would be only with 15%+ quarterly YoY growth returns. If consumers wait for Lilly’s pill, or if the results aren’t as good as expected, Novo is not a fired up sale. It is a healthy company at a correct valuation.

Technically, we’ve seen massive volume and a potential bottom. We saw a “lower low” right before the FDA approval, followed by a strong pump after. Do not rush, do not FOMO, we haven’t missed any train yet. We always have time before buying & we’d better be sure when we do.

There is volume. There is interest. But there is also a healthy dose of skepticism. While we are closing above the Weekly 21 for the first time in months, we haven’t seen a new higher high yet, nor have we confirmed a “crystal clear” double bottom.

I strongly believe we will see ~$55 again, very probably $50 during a retest. This is when decisions will matter. This was a “falling knife,” but now we are in a potential turnaround situation. The potential is here - the Wegovy pill, but the results aren’t in the books yet. The market isn’t pessimist anymore, but it isn’t overly optimistic neither, not yet at least.

This is the perfect window to start a pilot position and wait for technical confirmation.

Investment Execution

Once again: Without a 15%+ YoY quarterly growth, Novo doesn’t deserve to trade at a premium. It’ll deserve to trade north of 6x Sales from this growth rate, not before, based on its historical multiples.

If the bull case is correct - the Wegovy pill expands the market and steal shares from lilly, a 15% growth rate becomes the base case. This justifies a multiple of 6.5x to 7x Sales, which would put the stock price at roughly $75.

This has to happen in the next 6 to 9 months, before Lilly goes to market and either takes its shares back, or compete with an equivalent product. If Novo show its 15% quarterly growth then, it’ll deserve its 6x sales floor, give us our returns, and start a new narrative of which GLP-1 pill is the best.

The perfect bull case is for Wegovy to be the better, in which case Novo will become the new Lilly. But that’ll be step 2.

That gives us our timeframe (September to December), our target (at 7x sales we’re looking at ~$75), and we know our bottom (~$45).

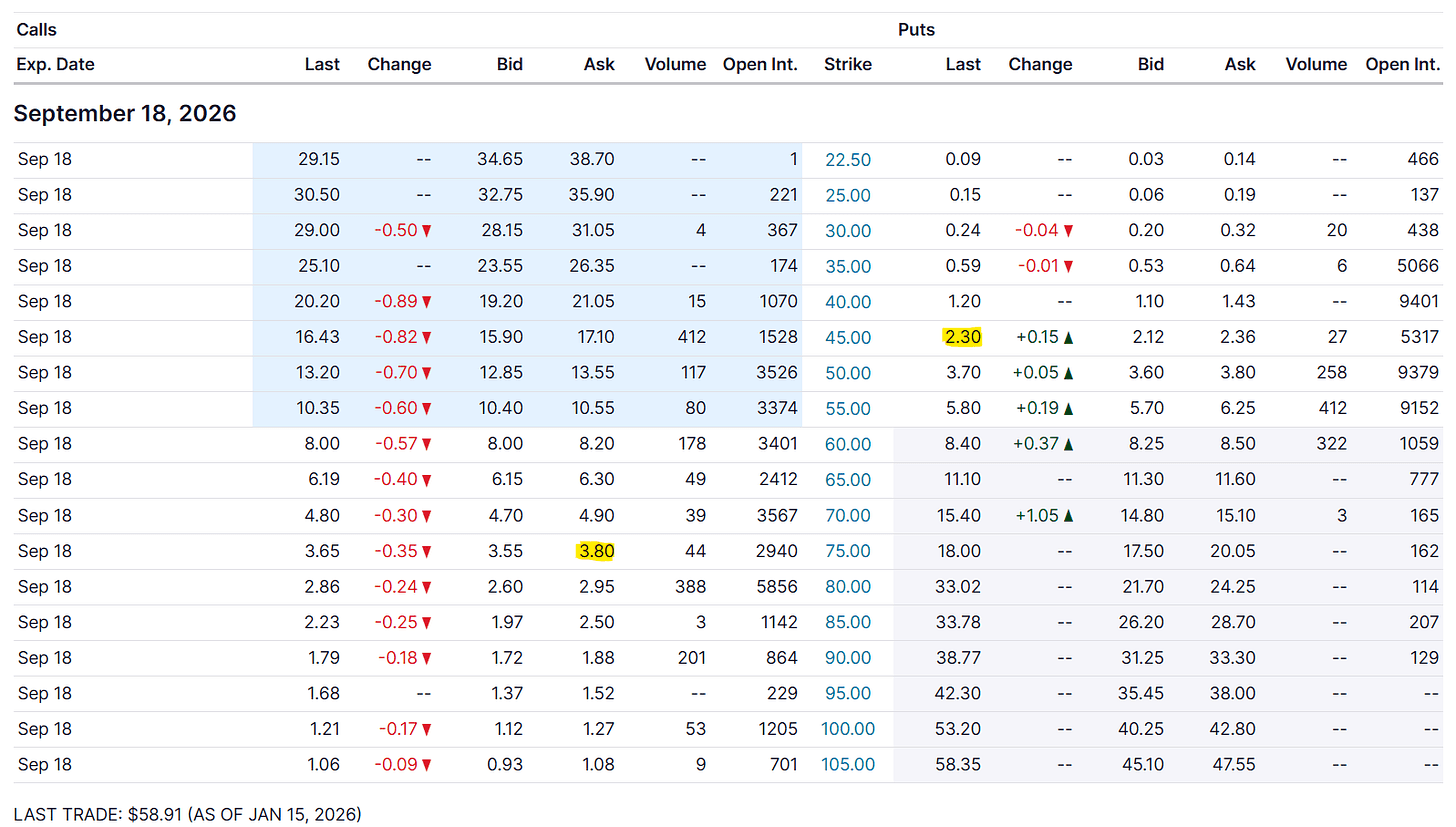

Options pricing isn’t very cooperative with the recent volatility. At current prices (~$58), the setup looks like this:

Sold put $45. Collect ~$2.30.

Buy $75 Call. Pay ~$3.80.

Roughly a $1.50 debit per contract.

It’s possible to sell two puts to buy one call for a $0.80 credit but that’d engage more collateral for one call of unlimited upside. And as usual, there are thousands of ways to play that name - buying shares being a great one as well.

Personally, I’m waiting for the stock to breath and my target to trigger my buys is ~$50. The same trade could be much more interesting by then, so I’ll be patient & adapt when the time comes.

Novo’s success now relies on execution. I’ll wait for that double bottom & $50. At that price, I believe the downside risk is limited, and the risk/reward is great now that we have a clear growth lever. If the pill succeeds, the upside is explosive. And there is a timeframe free of competition.

Once again: the risk reward seems great to me.

Conclusion

These are two solid names and solid setups to watch. We’ll check back in six months to see how the played out.

I’m personally interested b both . My ideal scenario is to see the retests hit in the next 60 days so I can take profits from my crypto trades - hopefully, and maybe from my AI trades. The risk/reward on those two is far more attractive than chasing tech at all-time highs to my opinion, especially with the option plays.

So my plan is clear: wait for the retest and the situation to shape up, then strike. I’ll without any doubts buy one of those setups. Maybe both.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.