Jan 15, 2026

A defensive delivery asset going through a transformation after breaking up with Amazon, redirecting resources toward more profitable clients.

I’m sure you know the company, if only for its big brown and yellow trucks. And you are probably asking: Why on earth would I buy an old, dying delivery service?

Fair question. Social media teaches us to invest only in “the future,” hold for 20 years, & hope for the best. But UPS is a defensive asset. If you haven’t noticed, defensive assets have been firing for the last six months, they outperformed the market by a wide margin.

There’s a reason for that: Risk Appetite. Liquidity is flowing out of tech and into “safe havens”; companies that keep working regardless of what happens with AI buildouts, tariffs ruling or interest rates.

I’ll let ChatGPT tell you about it, so we still use some compute in the process.

Business:

UPS transports small packages, freight, and supply-chain solutions worldwide, serving consumers, SMBs, and large enterprises across B2C and B2B channels.Business model:

Asset-heavy, network-driven model built on owned hubs, aircraft, vehicles, and routing software. Revenue is generated per shipment, with pricing tied to weight, distance, speed, and service level. Scale, density, and network optimization drive margins, while long-term contracts and enterprise customers provide recurring volume.

The bull case isn’t much about firing up fundamentals; it’s about stability. Even if tech melts down, UPS continues to generate stable revenue. Right now, stability is on sale.

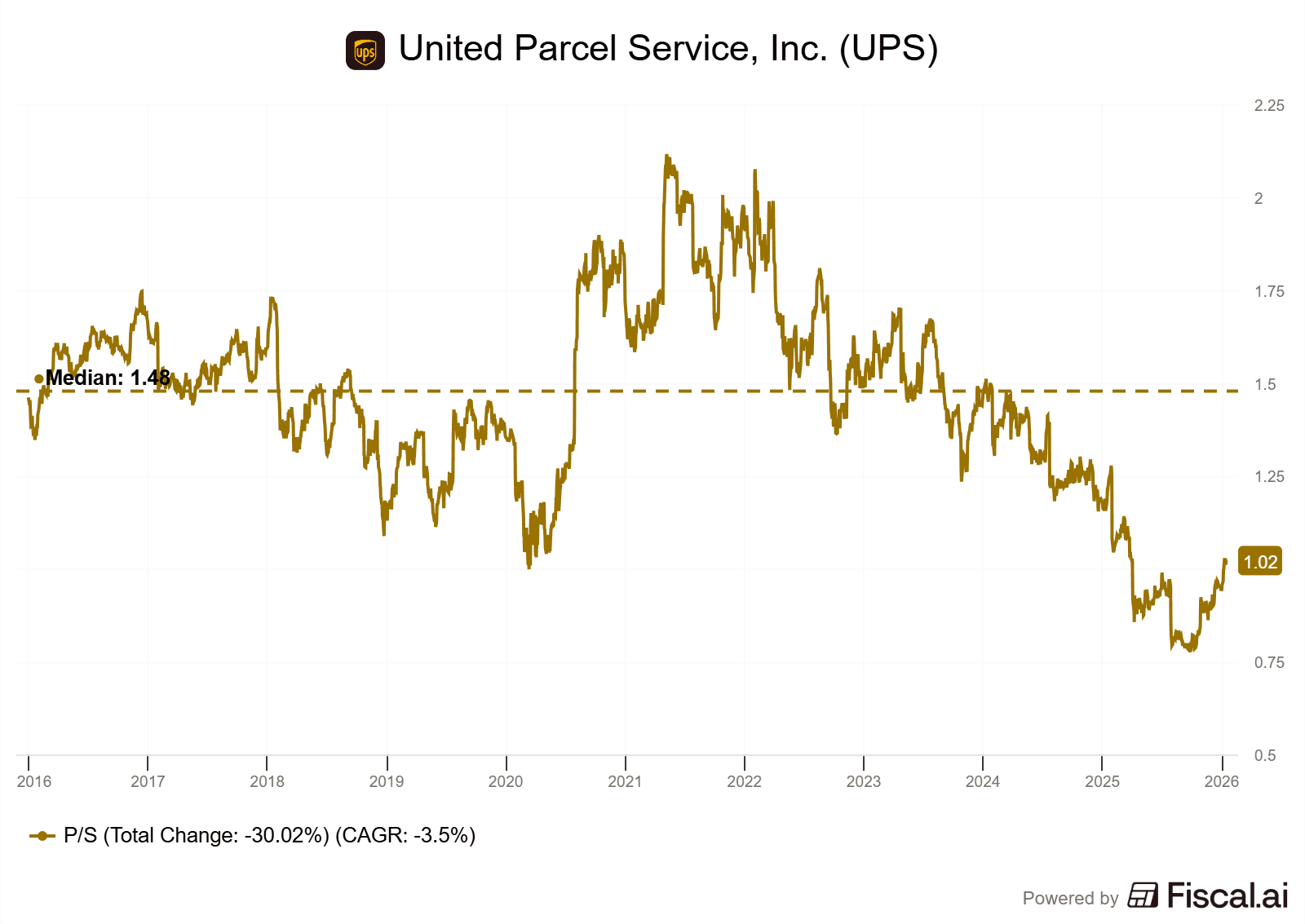

UPS is trading at a valuation much lower than its historical average, and it pays a 6% dividend while you wait. I’d rather buy “boring” stocks that make money than “sexy” stocks that lose it.

And if it isn’t sexy, remember: the ~50% of average returns of the other unsexy stocks shared above yielded enough money to buy lots of sexy things. I’d rather buy sexy things that make money on sexy stocks. But that’s me.

Investment Execution

As usual, there are hundreds of ways to play a stock. You can buy the common shares, sit back, and collect that 6% yield. That’s a great plan. If you know me, you know I’ve a more aggressive plan, an option plan made possible by the situation.

Very low valuation.

Very low risks.

Very low volatility.

Perfect price action.

UPS has been in 4Y downtrend. It hasn’t stayed above its Weekly 50 or 21 - green and red line respectively, for more than a handful weeks.

What do we see now? A local bottom. A break above the Weekly 21 and 50. Price is sticking above these lines, meaning buyers are awake. And massive volume. Nobody talks about this stock because it isn’t a growth or an AI name. But if this stock were called Palantir, the entire world would be talking about it.

The trade is simple. Since the risk is low and demand is clear, I’d be aggressive and use options. Because “nobody cares” about UPS, the premiums are attractive.

Timeframe. Taking the previous companies as example, it took them ~6 months to go from the perfect setup I shared to where they are today, up an average of ~50%. UPS is in that perfect setup now, so if the rotation continues, we can expect great returns in the next 6 to 9 months.

Target. We’d need a 50% gain to reach UPS median P/S, pushing the stock ~$150. A bit higher but let’s keep it conservative.

The Setup. UPS trades ~$108 at time of writing. The perfect entry would be on the $100 retest, or close to it, while the bottom is supposed to be set around $90. The trade already seems great at today’s price, but I’d still wait for that retest to buy in, meaning an even better setup/prices.

Expiration January 15, 2027, giving us more room.

Sell 1 Put at $85: Collect ~$430 in premium.

Buy 2 Calls at $150: Cost ~$201 per call (Total $402).

You get paid roughly $28 per contract to enter a trade with unlimited upside and a contract to buy shares at $82.2, hence a required collateral of $8,220 assuming no margins are used. With a year to go, I’d gladly use lots of margin & would reduce it during the next months if the trade doesn’t shape well.

I know this isn’t drones, robots, space data centers or flying unicorns. But while the unicorns are struggling to make new highs, these defensive setups are becoming the real unicorns of 2026 from a return perspective. Diversification won’t hurt, it might actually be the thing that saves your year if the rest goes south.

And having one unicorn in one’s bag can make a huge difference.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.