Jan 27, 2026

Firearm manufacturer at low valuation. Inventories have been cleared after struggling quarters, demand for new products is growing, insecurity sentiment is rising in the region, and export restrictions have been lifted or reduced.

Let’s be polarizing and talk about the firearms industry. As usual, I am not here to talk ethics. I am here to present investment setups. I’ll let you manage your own ethics and do as you wish. So, here goes.

Smith & Wesson is America’s oldest and most recognizable firearms manufacturers, founded in 1852. Revenue is almost entirely from selling handguns (~72%), long guns/rifles (~20%), and accessories/suppressors (~8%) to consumers, retailers, and law enforcement.

The business model is straightforward manufacturing & wholesale distribution, they design and produce firearms at their Tennessee facility and sell through dealers, distributors, and sporting goods retailers.

Demand is driven by self-defense, sport shooting, and collecting, with notable sensitivity to political cycles and regulatory sentiment.

This could be seen as a cyclical industry based on political climate. Dare I say that the political climate is tense in the U.S.? Not here to discuss politics neither so again, have your own opinion, but in mine, last year’s news speaks for itself.

Second, this is also about regulation. Trump’s administration has been pro-firearms, reducing export controls internationally and loosening local regulations. Add to this the combination of the two previous companies: potential growth acceleration, low valuation, and a defensive, ignored asset.

Management is expecting healthy growth moving forward, and that growth is driven by new products, so this isn’t about catching up, it is a clear new trend supported by real demand.

After inventory fluctuation adjustments, our total firearm unit shipment into the sporting good category were up 3.3% versus the market being down 2.7%.

We expect our third quarter sales will be 8% to 10% over our Q3 fiscal 2025 sales. Q4 is always our strongest quarter... this year, I don’t think it’s gonna be any different. I think you can expect somewhere high single digit, low double digit growth in Q4 over Q3 this year.

Our new products continue to be a significant catalyst accounting for nearly 40% of sales in the quarter.

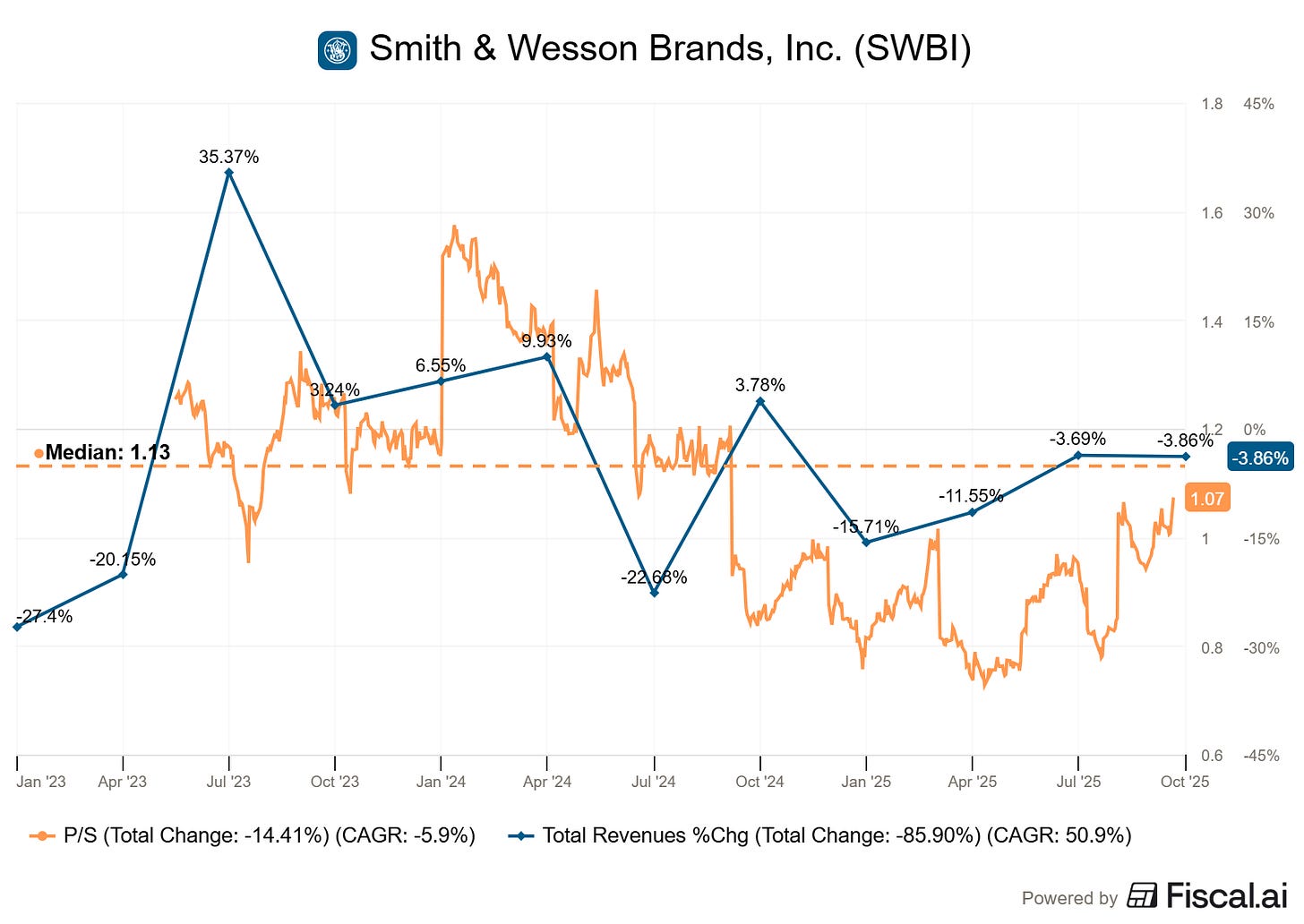

The last year that closed with double-digit growth was rewarded with 1.5x sales. We are very far from that happening, but with positive comments for the next quarters, a clear trend and healthy inventory - which means what is sent to wholesalers is being bought, stocks have been cleared. This was a problem in recent quarters not to worry about anymore.

Seems like a lot of positive news.

Investment Playbook

We are a bit late to the party. The breakout, average reclaim, and retest already happened around ~$10.

We haven’t yet cleared another higher high, meaning price could still range between the current higher her and the earlier one - between $10 and $11.50. Any retest in the $10 area would be a great purchase. If that doesn’t happen, it means we’d need to buy the next breakout retest around $11, which remains healthy but of course less interesting.

I wouldn’t make my base case a 1.5x sales as growth is hard to predict and a double-digit growth year still seems far-fetched today, but if the trend continues we’d be looking at a higher multiple than today’s and easily a 20% - 30% push from my $10 target.

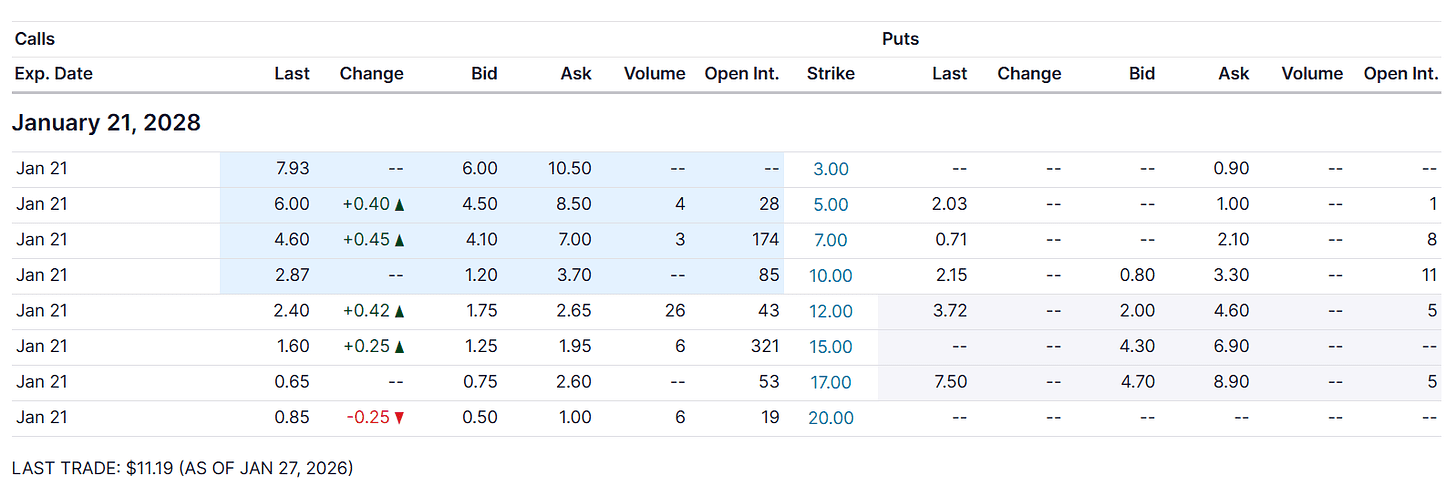

Any options trade would require you to go further than January 2027, as regulations shouldn’t change - except if Trump were to be removed in the midterms, & demand or the climate shouldn’t improve during the period - that’s only a personal opinion, but the long term growth acceleration remains unconfirmed yet, even if Q3 was a beat and Q4 guidance came above expectations.

Pushing to January 2028, which wouldn’t be impacted by the November presidential elections yet, with a floor at $10 and a target at $15, you’d be paid $0.90 to take that trade for $1,000 of collateral - much less considering the two-year timeframe, which gives room for a margin positions. Prices would be even better if we were to retest that $10 region, but the trade already seems great today.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.