My Investing System

My Investing System

Why Don't I Buy Downtrends?

Why Don't I Buy Downtrends?

Why Don't I Buy Downtrends?

Downtrends is the market’s way to tell you something is wrong

Sometimes it’s an overreaction; often the market understands things we don’t.

As retail investors,

We do not have the resources to do ground research;

spend hundreds of hours studying a company,

or understand complex topic outside of our capacities.

Price action is our leverage to know what we couldn't know.

If the market sells the stock you want to buy…

There is a probability that you misunderstood something.

Buying a downtrend and being wrong means…

You'll be holding degrading fundamentals.

Your position will shrink even if you were right.

The time for the market to realize its mistake can cost a lot.

Being right or wrong means underperformance.

This is a lose-lose situation.

Buying a downtrend is pretentious

It is assuming to know better than the market.

You will be wrong 99 times our of 100.

And that time won't be worth it.

If you were to be right

The market will eventually turn. Price action will ameliorate.

The concepts shared on the previous page will materialize.

And opportunities will arise.

Why push your luck?

Dollar-Cost Average

The action of buying a stock regularly, usually during a downtrend.

In time, you will have a fair average cost and "great returns".

DCA is a suboptimal and overvalued strategy

It is a waste of time, energy and mental health.

DCA means holding a shrinking position with higher risk based on a personal bias.

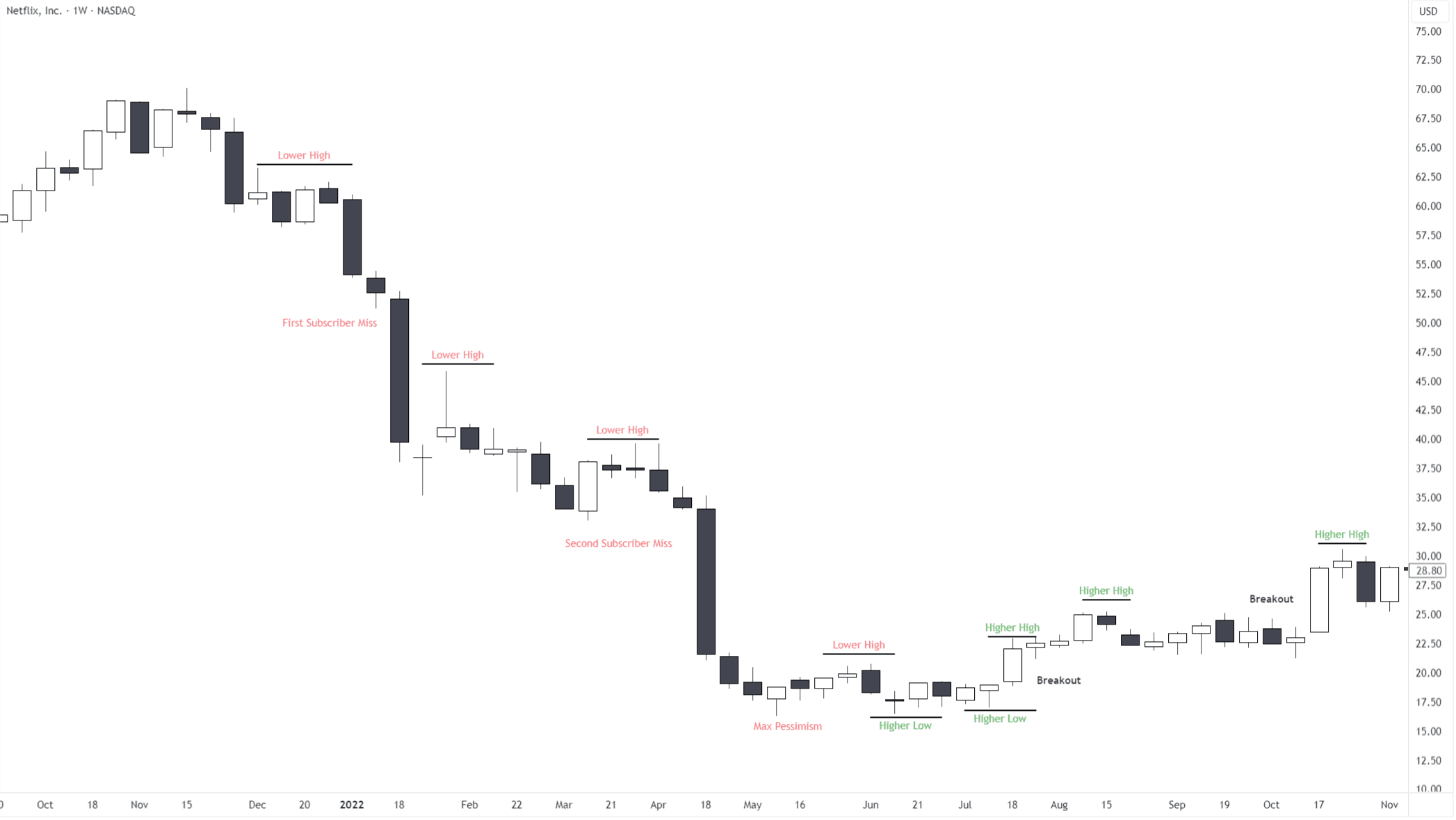

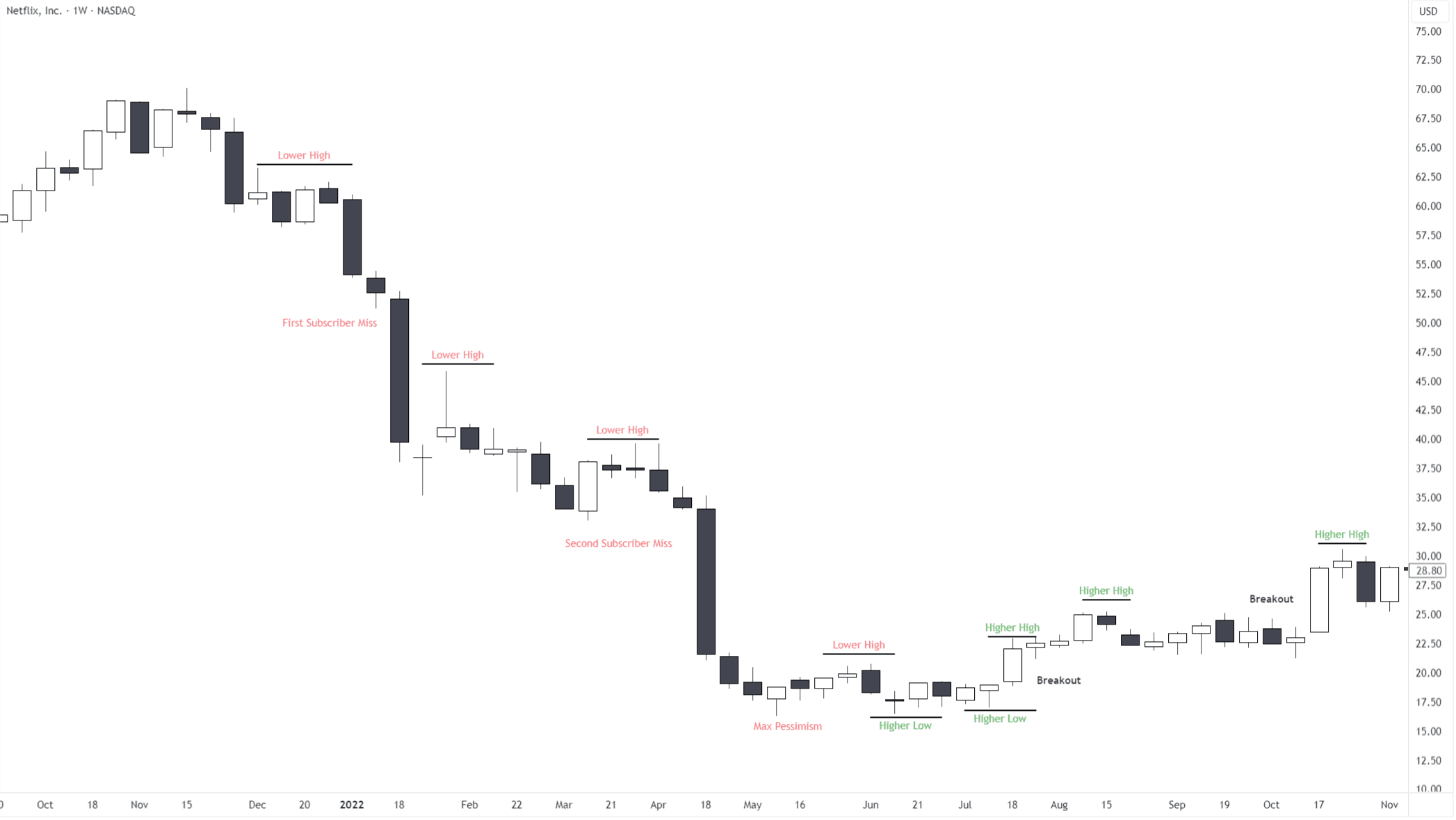

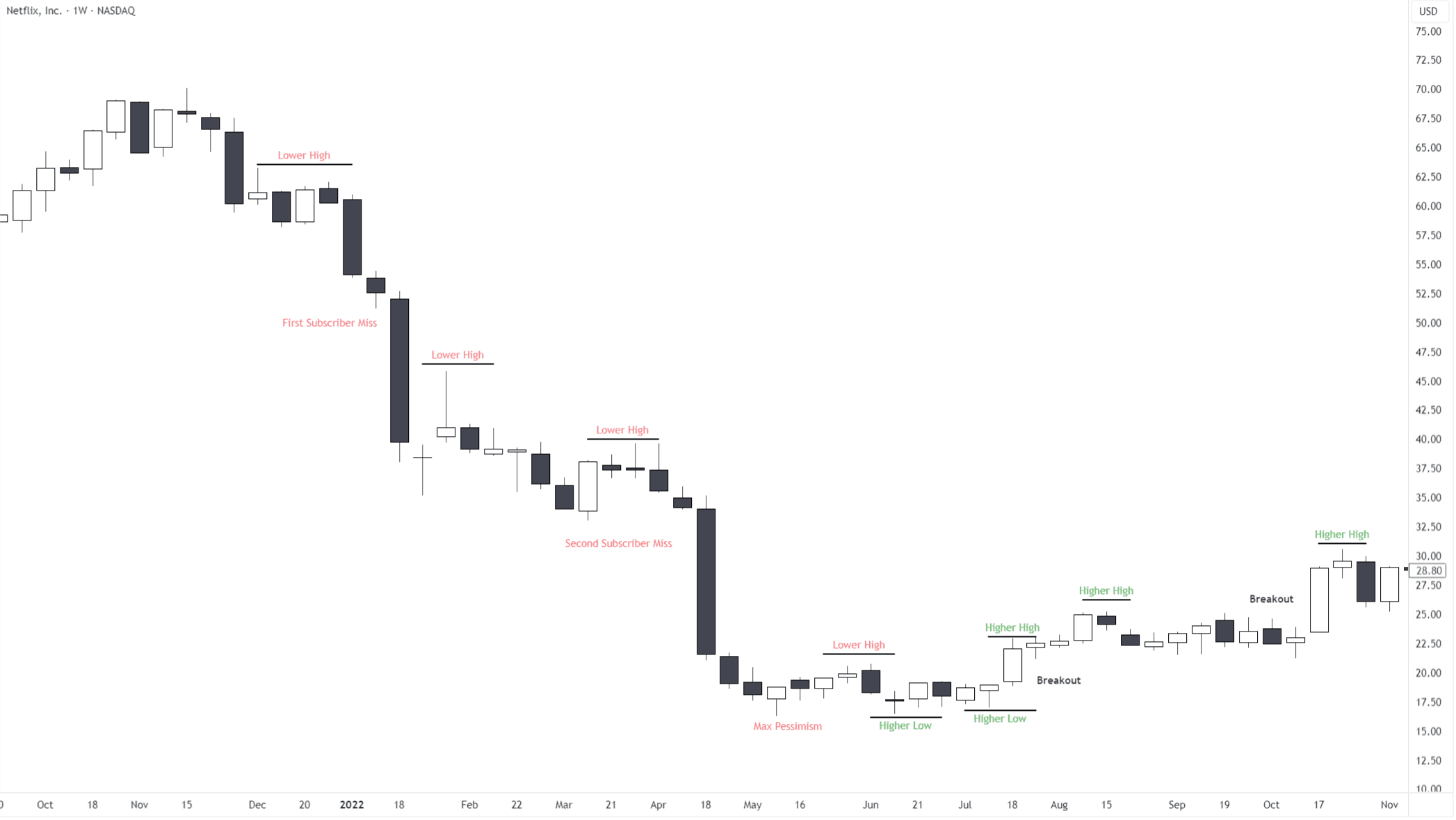

Let's use Netflix as an example

If you decided to DCA in 2021 because

it will obviously bounce back.

Netflix is the future of streaming.

And you were right.

But you couldn't know; this is hindsight bias.

You know it because it happened.

At the time, you could only hope.

If you bought after Q4-21 at $40

It took 1 year and 4 months to get back to that price.

No gains, just breakeven.

If you averaged down from $40 to the bottom at $16

You could have built an average at the medium ~$28.

Netflix didn’t revisit this price until October 2022.

10 months after the first purchase.

You had to go through uncertainties, a shrinking user base & no reassuring data.

Execution Risks. What if your conviction was wrong and Netflix never recovered?

Timing Risks. What if Netflix had taken 3 or 4 more years to come back?

Psychology risks. Would you have been able to hold while your portfolio kept shrinking?

Most people gave up and sold.

While price action showed you what you needed to know.

The market didn’t want anything to do with Netflix for more than a year.

Downtrends is the market’s way to tell you something is wrong

Sometimes it’s an overreaction; often the market understands things we don’t.

As retail investors,

We do not have the resources to do ground research;

spend hundreds of hours studying a company,

or understand complex topic outside of our capacities.

Price action is our leverage to know what we couldn't know.

If the market sells the stock you want to buy…

There is a probability that you misunderstood something.

Buying a downtrend and being wrong means…

You'll be holding degrading fundamentals.

Your position will shrink even if you were right.

The time for the market to realize its mistake can cost a lot.

Being right or wrong means underperformance.

This is a lose-lose situation.

Buying a downtrend is pretentious

It is assuming to know better than the market.

You will be wrong 99 times our of 100.

And that time won't be worth it.

If you were to be right

The market will eventually turn. Price action will ameliorate.

The concepts shared on the previous page will materialize.

And opportunities will arise.

Why push your luck?

Dollar-Cost Average

The action of buying a stock regularly, usually during a downtrend.

In time, you will have a fair average cost and "great returns".

DCA is a suboptimal and overvalued strategy

It is a waste of time, energy and mental health.

DCA means holding a shrinking position with higher risk based on a personal bias.

Let's use Netflix as an example

If you decided to DCA in 2021 because

it will obviously bounce back.

Netflix is the future of streaming.

And you were right.

But you couldn't know; this is hindsight bias.

You know it because it happened.

At the time, you could only hope.

If you bought after Q4-21 at $40

It took 1 year and 4 months to get back to that price.

No gains, just breakeven.

If you averaged down from $40 to the bottom at $16

You could have built an average at the medium ~$28.

Netflix didn’t revisit this price until October 2022.

10 months after the first purchase.

You had to go through uncertainties, a shrinking user base & no reassuring data.

Execution Risks. What if your conviction was wrong and Netflix never recovered?

Timing Risks. What if Netflix had taken 3 or 4 more years to come back?

Psychology risks. Would you have been able to hold while your portfolio kept shrinking?

Most people gave up and sold.

While price action showed you what you needed to know.

The market didn’t want anything to do with Netflix for more than a year.

How could you know?

Constant rejections at daily moving averages.

Lower lows for months.

No clear bottom.

Until when?

Max pessimism around June; Netflix traded below 3× P/S.

In August, the stock broke out of a 4-month range.

It also reclaimed its moving averages.

The market turned. Demand showed up.

By then, we had our confirmations.

Sequential user growth in Q2 with optimistic outlook.

Positive price action with a breakout.

Very low multiples.

These confirmations happened below $28.

The retest of the daily moving average happened ~$23.

Lower than the cost basis of most people who DCA the downtrend.

Price action and patience avoided all risks.

And yielded a better opportunity than if you took them.

Patience is a virtue.

For those willing to put the time, and the work.

Which is what I do for you here.

Timing the market is possible.